Navigating Change in South Korea: What to Expect from President Lee Jae-myung

President Lee Jae-myung’s election marks a rare moment of institutional alignment in South Korean governance. With both the executive office and National Assembly under Democratic Party control, the administration takes power with a broad legislative mandate and one of the most far-reaching reform agendas in recent memory. This is more than a leadership change—it is a consolidation of political authority with lasting implications for how policies are conceived, enacted, and implemented.

The Lee administration enters office amid global economic headwinds, domestic political fatigue, and heightened demand for systemic change. In contrast to his predecessors, Lee is positioned to act with speed and coherence, driving a state-led policy transformation centered on economic redistribution, digital sovereignty, climate transition, and social equity.

This report outlines the Lee government’s core priorities, institutional configuration, and governing style. Drawing from campaign pledges and early-stage coordination signals, it offers strategic insights for organizations seeking to understand the new policymaking environment, engage meaningfully, and align effectively within Korea’s evolving political landscape.

Report Summary

Political Context and Power Shift

The early 2025 election followed the impeachment of President Yoon Suk-yeol and public demand for systemic reform. Lee secured a decisive victory, supported by an existing legislative majority from the 2024 general election. This outcome facilitates fast-tracked policymaking and centralized governance with minimal legislative gridlock.

Policy Agenda Overview

- Economy: Universal basic income pilots, expansionary fiscal policy, and anti-trust measures.

- Industrial Strategy: “ABCDEF” sectoral focus (AI, Bio, Culture, Defense, Energy, Factory Tech), publicly led innovation, semiconductor resilience.

- Energy and Climate: RE100 zones, green energy infrastructure, carbon pricing, and rural dividends.

- Social Policy: Expansion of public housing, social care, labor rights, and a reduced workweek.

- Foreign and Security Policy: Diplomatic rebalancing, supply chain re-shoring, phased inter-Korean engagement, and non-escalatory defense modernization.

Institutional Strategy

The presidential office and the Democratic Party will closely coordinate legislative timing and policy implementation. The first year’s legislative focus includes: supplementary budget and ESG regulations, as well as industrial and labor bills. Implementation will leverage public sector institutions and cooperating local governments.

Strategic Risks

The perception of unchecked power, bureaucratic overload, and internal party factionalism may disrupt execution. Heightened public and media scrutiny necessitates transparency, legal compliance, and social accountability from all actors.

Strategic Implications

The Lee administration is accelerating a state-led transformation model marked by speed, centralization, and ideological clarity. For businesses, this is a critical moment to act early, speak the language of policy, and redefine themselves as execution partners of the national agenda.

- Prioritize policy alignment. Influence will depend on how early and effectively stakeholders align with the government’s stated priorities.

- Align with the language frame. Proposals should adopt the administration’s core policy terms, such as economic fairness, national competitiveness, and digital sovereignty, to enhance resonance and credibility.

- Ground proposals in public value. Business objectives should be framed as contributors to national outcomes, emphasizing collective goals over narrow interests.

- Adopt a multi-layered network strategy. Engagement should encompass not only ministries but also legislative committees, party policy teams, and local governments.

- Integrate communications and public affairs. External messaging must be grounded in transparency, social responsibility, and shared interests. Monitoring allied civil society groups is also crucial to ensure legitimacy and alignment in a politically sensitive environment.

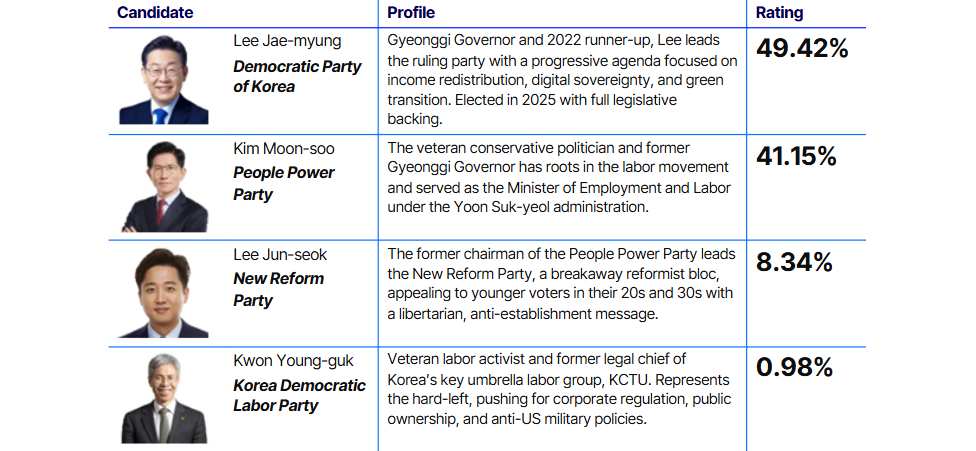

Election Outcome and Political Shift

The 2025 presidential election took place under extraordinary political and economic conditions. Following the impeachment of former President Yoon Suk-yeol in April 2025, the country faced a period of political uncertainty. The early presidential election, called to restore democratic legitimacy, served not only as a referendum on the conservative bloc but also as a critical reset moment for national priorities amidst rising economic pressures, geopolitical volatility, and public demand for clearer policies.

The voter turnout reached the highest level in 28 years at 79.4%, which includes early voting with a turnout of 34.74% across the country. This exceptionally high turnout is widely interpreted as a reflection of the public’s heightened desire to select a leader capable of providing direction and stability during a time of national uncertainty.

By the end of the night, Lee Jae-myung of the Democratic Party claimed victory. Lee and the Democratic Party’s triumph was anticipated from the outset of the race due to the widespread discontent with the Yoon administration and the larger conservative bloc. Lee’s victory, coupled with the party’s existing legislative majority from the 2024 general election, paves the way for a significant establishment of a unified government.

Armed with this two-tiered mandate, the incoming administration now possesses unprecedented authority to legislate and govern with strategic coherence. This dual control of the Presidential Office and the National Assembly, effectively bringing an end to a period of divided government under the previous administration, prepares the ground for expedited policy implementation and bold agenda-setting, free from legislative gridlock.

Not Just a Power Shift, But a Structural Realignment

Instead of merely continuing the political trajectory of the Moon administration or rectifying the course of the ousted Yoon government, the Lee Jae-myung presidency signifies a structural realignment of political authority. The electorate’s choice mirrors a profound public aspiration for predictable governance, economic justice, and a proactive national stance in an era of global uncertainty.

The impeachment of former President Yoon Suk-yeol and the interim government’s limited capacity created a governance vacuum that this election decisively filled. With legislative and executive powers aligned, the Lee administration is now poised to pursue its key policy pillars—from universal basic income and green industrial transformation to AI sovereignty and democratic reforms—without procedural delay.

A less publicly articulated but politically significant aspect of Lee’s early governance is the commitment to restore “internal peace”—a campaign framing that implies a broader agenda of institutional accountability. In practice, this is expected to initiate a wave of legal scrutiny aimed at political opponents, elements of the judiciary, and potentially corporations associated with the previous administration.

While presented as part of judicial reform and democratic normalization, this action could entail reputational or compliance risks for the institutions involved. Stakeholders should monitor legal trends and prepare for heightened transparency demands and investigations in politically adjacent sectors.

Strategic Implications of the Political Realignment

The election was less about partisanship and more about reordering priorities. Lee successfully framed the national agenda around “economic transformation through fairness” and “a state that protects livelihoods,” signifying a shift from market-driven orthodoxy to redistributive pragmatism.

Institutionally, the near-total control of the National Assembly eliminates legislative bottlenecks and facilitates the swift deployment of fiscal and regulatory tools. Politically, however, this level of dominance may attract criticism for overreach, rendering stakeholder dialogue and issue-specific consensus-building increasingly crucial for both public and private actors.

Core Policy Agenda of the Lee Administration

President Lee Jae-myung assumes office with a strong mandate and complete legislative control, enabling a bold and comprehensive policy agenda. His administration’s key priorities encompass five areas: the economy, industrial strategy, energy and climate, social policy, and foreign affairs. Here’s what the business, policy, and investment communities can anticipate over the next 6–18 months.

Economic Policy: Redistributive Growth and Fiscal Expansion

- Universal Basic Income (UBI) as a structural equalizer: The administration plans to initiate UBI pilot programs, initially targeting young people and rural residents. The aim is not to implement it immediately or universally, but to foster public support and develop a fiscal infrastructure for scaled implementation over time. This initiative is part of a broader “Basic Society” model in which a minimum standard of living is state-guaranteed.

- Relaxation of fiscal rules to enable social investment: Lee has pledged to ease rigid fiscal discipline by amending the fiscal soundness framework introduced under previous administrations. This would facilitate a significant increase in public spending, particularly in housing, jobs, and cost-of-living subsidies, while pursuing progressive tax reform to fund these priorities.

- Market fairness and anti-monopoly enforcement: The administration is expected to enhance oversight of large conglomerates and digital platforms. This includes measures such as mandatory price transparency, expedited payment mandates for subcontractors, and expanded enforcement by the Korea Fair Trade Commission (KFTC). Lee has advocated a “one-strike-out” system for stock price manipulation as part of broader capital market reform.

Industrial Strategy: Strategic Autonomy through Public-Led Innovation

- “ABCDEF” sectoral initiative to drive national reindustrialization: The administration will launch substantial public investments in six strategic sectors: AI, Bio, Culture, Defense/Aerospace, Energy, and Factory Tech. This will encompass tax incentives, export guarantees, and equity support for domestic firms.

- National AI infrastructure and human capital development: The administration aims to catalyze AI-related investment totaling KRW 100 trillion (USD 72.6 million) across public and private sectors. Initiatives include the construction of national GPU clusters, open-access AI platforms (“AI for All”), and the expansion of AI-focused academic programs with military service alternatives for AI talent.

- Semiconductor competitiveness under geopolitical pressure: While semiconductors remain Korea’s leading export, the administration is concerned about long-term vulnerability amidst US–China tech decoupling. In response, the government will increase upstream R&D funding and incentivize domestic chip production through regulatory support and joint-venture facilitation.

- Digital public infrastructure for economic sovereignty: The administration will promote digital sovereignty by expanding domestic cloud infrastructure, open government data platforms, and localized standards for cybersecurity and data storage, aiming to reduce reliance on foreign technology providers.

Energy and Climate Policy: Green Transition with Local Dividends

- Energy superhighway and RE100 zones: A national “energy superhighway” project—focused on the West Coast—is anticipated to modernize Korea’s grid and support large-scale wind and solar deployment. The plan includes RE100-certified industrial zones, where 100% clean energy encompasses both renewables and nuclear power. This reflects a strategic shift in Korea’s clean energy taxonomy. This could be adjusted to focus on CF100 certification, as Lee additionally remarked to recognize nuclear power as part of its long-term decarbonization and energy security mix. These zones are expected to attract investment in green manufacturing, digital industries, and high-energy-intensive sectors seeking ESG alignment.

- “Sunlight & Wind Pensions” to revive rural economies: In a distinctive approach to a just transition, Lee’s campaign proposed that communities hosting renewable energy projects receive long-term dividend payments. This policy aims to distribute climate profits locally while revitalizing depopulated areas.

- Carbon taxation and green regulation: A pilot carbon tax may be introduced in select industries, alongside a green transition fund, to mitigate its impact. Mandatory ESG disclosure rules could be expanded, and public procurement regulations will be revised to prioritize low-emission suppliers.

Social Policy: The Basic Society and Labor Rights Expansion

- Cradle-to-grave social guarantees through a “Basic Society” model: The government seeks to enhance public provision for child allowances, housing, and caregiving services. Care infrastructure will be nationalized or substantially subsidized across childcare, eldercare, and disability services, ensuring nearly universal access regardless of income or employment status.

- Massive expansion of public housing and rent control: Lee has pledged to significantly increase the supply of public rental housing, particularly in the Seoul metropolitan area. Legislative measures to limit rent increases and prevent speculative pricing in lease markets are also anticipated within the first year of the term.

- Legal protection and inclusion for platform workers: The government is developing a new legal framework to recognize platform workers, such as delivery drivers and app-based freelancers, as formal labor. This would entitle them to minimum wage protections, collective bargaining rights, and inclusion in public insurance systems.

- Toward a shorter workweek through phased negotiation: The administration supports exploring a phased reduction in working hours, including 4.5-day models, through extensive labor-management consultations. This would begin with voluntary pilots in specific industries and evolve into broader policy through tripartite dialogue between labor, business, and government.

Foreign and Security Policy: Pragmatic Diplomacy and Inter-Korean Engagement

- Rebalancing diplomacy amid US tariff tensions: Lee’s administration is expected to maintain the US alliance while asserting a more independent stance. The Liberation Day tariff episode has intensified calls for greater economic autonomy, and Lee has already signaled support for diversifying trade relationships towards ASEAN, the Middle East, and Eastern Europe.

- Supply chain diversification and trade re-shoring incentives: The Korea Trade-Investment Promotion Agency (KOTRA) and the Ministry of Economy and Finance (MOEF) are set to enhance support for Korean exporters targeting non-US markets. At the same time, new incentives will promote domestic re-shoring and joint ventures with non-aligned economies, especially in clean tech and semiconductors.

- Stepwise re-engagement with North Korea: Unlike his predecessor, Lee supports the gradual reopening of economic and humanitarian channels with Pyongyang. The reactivation of the Kaesong Industrial Complex and prospective new economic cooperation zones are under consideration, contingent upon geopolitical circumstances.

- Security modernization without escalation: While military cooperation with the US will continue under the Mutual Defense Treaty, the administration plans to modernize Korean defense capabilities using AI, drone technology, and cyber resilience. It also supports de-escalation strategies to mitigate cross-border tensions on the peninsula.

Strategic Considerations for Business

With executive and legislative power consolidated under President Lee Jae-myung, businesses across various sectors must reevaluate their positioning, engagement strategies, and policy alignment. The new administration’s focus on redistribution, strategic autonomy, and robust regulatory enforcement will present both opportunities and risks, contingent on sectors’ exposure and preparedness.

Policy Alignment Opportunities

- Government Agencies and SOEs: Government ministries, affiliated institutions, and state-owned enterprises are expected to play a central role in implementing Lee’s flagship initiatives—particularly in public housing, energy transition, and industrial innovation. Institutions such as LH (Korea Land & Housing Corporation), KEPCO, and KOTRA may see expanded mandates and budgets linked to RE100 zones, AI clusters, and housing supply plans. Early alignment with presidential pledges will enable them to lead pilot programs and receive priority funding.

- Private Sector and Strategic Industries: Firms operating in Lee’s strategic industries (AI, Bio, Culture, Defense, Energy, Factory tech) will find clear government backing in various forms of subsidies and incentives. Companies engaged in green manufacturing, digital public infrastructure, or localized supply chains should align their messaging and proposals with the administration’s themes of “national competitiveness” and “social fairness” to access state-led growth initiatives.

- Local governments: Provinces and cities led by Democratic Party mayors or governors are set to become testbeds for national policy trials. Stakeholders in these areas will discover enhanced funding channels and opportunities for direct collaboration with central ministries on education, mobility, climate adaptation, and welfare delivery.

- Civil Society and Advocacy Organizations: The administration has committed to “direct democracy” and social dialogue through digital platforms and deliberative bodies. While it has expressed openness to participatory governance via these channels, the first 90 days are anticipated to function as a de facto transition period, placing emphasis on internal moderation and messaging recalibration. During this phase, stakeholders should prioritize strategic monitoring of personnel appointments, policy tone, and legislative sequencing rather than engage in early-stage advocacy. Civil society’s direct influence may be more limited during this window as the administration works to consolidate message discipline and policy direction.

Policy Risks and Pressure Points

- Regulatory Exposure for Large Corporations and Platforms: Lee’s administration is anticipated to vigorously pursue fair trade enforcement, platform regulation, and protections for subcontractors. Large conglomerates, particularly in retail, delivery, fintech, and media platforms, may encounter pricing audits, commission caps, reviews of labor classifications, and updated antitrust regulations. Proactive compliance planning will be crucial to prevent reputational or legal risks.

- Public Procurement and ESG Conditionality: Major infrastructure and R&D projects will increasingly link eligibility to ESG performance, labor standards, and local content ratios. Organizations that fail to meet heightened carbon disclosure, social responsibility, or employment equity standards may be excluded from state projects. Foreign-invested firms will be expected to localize or partner with Korean entities to demonstrate policy alignment.

- Political Polarization and Backlash Risk: Stakeholders engaging too visibly with the administration risk being caught in ideological backlash, especially if reforms falter or if media frames a policy as overreach. Public sector unions, business lobbies, and academic institutions should develop nuanced, issue-specific engagement strategies that balance alignment with accountability, thereby avoiding perceptions of partisanship or opportunism.

In this environment, success will depend on stakeholders’ ability to move early, communicate public value, and manage exposure—positioning themselves not just as policy takers, but as credible contributors to the national agenda.

Strategic Outlook for Business

The Lee administration has introduced a faster, more centralized policymaking environment. For stakeholders, access and influence now depend less on relationships and more on how your organization align with national priorities.

- Engage early. With both the presidency and legislature under unified control, policy decisions move swiftly and often with limited public consultation. Stakeholders must position themselves prior to the introduction of legislation, during internal drafting stages or party-level planning—to exert meaningful influence. It is also crucial to monitor relevant policy updates and opinions of key policy influencers closely affiliated with the Lee administration by establishing a real-time media and social platform monitoring system.

- Speak in the terms of the Lee administration. Proposals should reflect the core policy frameworks of the Lee administration, such as economic fairness, national competitiveness, digital sovereignty, and climate responsibility. Language is important. Using terms aligned with the government enhances receptivity and positions your organization as a policy partner rather than a special interest.

- Frame proposals as national contributions. Successful engagement means connecting your objectives to national outcomes. For example, a housing project could be pitched as a regional equity initiative; a tech rollout could be positioned as infrastructure that enhances digital resilience. This framing creates alignment of interests and reduces friction.

- Understand that influence is networked. Influence no longer flows from the top-down. Proposals must resonate across ministries, legislative committees, party policy teams, and even local governments. Building alignment across these layers reinforces your position and ensures continuity during policy implementation.

- Prepare for public scrutiny. The Lee government’s reform agenda comes with significant public expectations. Media, civil society, and opposition voices will closely observe how major stakeholders engage. Communications must be rooted in transparency, social value, and shared goals—not self-interest or defensiveness.

In this environment, government relations and communication functions must be integrated. The organizations that succeed will be those that act early, communicate clearly, and operate transparently within the national interest framework established by the new administration.

Addendum: Projected Key Stakeholders in Lee’s Presidency

President Lee Jae-myung governs with the support of a deeply entrenched and multi-faceted political network. This group of long-time confidants, early political allies, emerging party leaders, and trusted policy experts constitutes the core of a centralized yet diverse power structure for Lee.

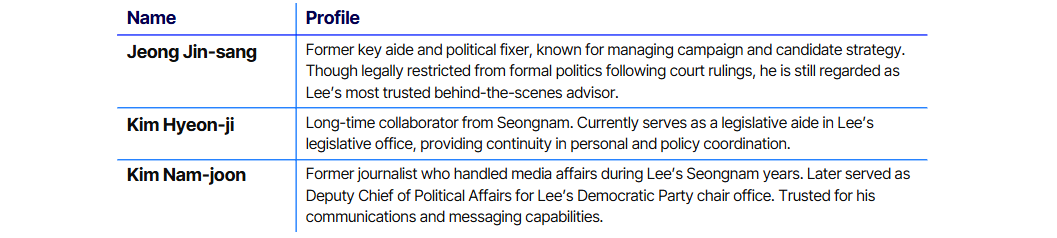

Seongnam–Gyeonggi Operational Core

This inner circle was established during Lee’s tenure as Mayor of Seongnam and Governor of Gyeonggi. Although some members of this inner circle hold no official positions due to legal or political restrictions, their influence remains significant.

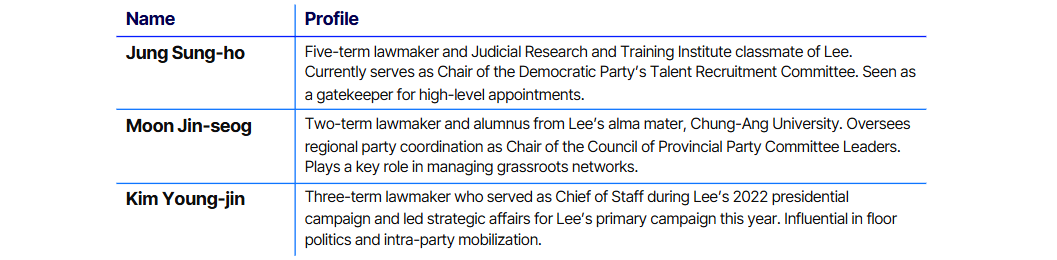

Original Pro-Lee Group (“7-man Clan”)

This group of senior lawmakers, many of whom have academic or regional connections to Lee, constituted the original strategic backbone of his national rise. Their political influence renders them essential in cabinet formation and legislative execution.

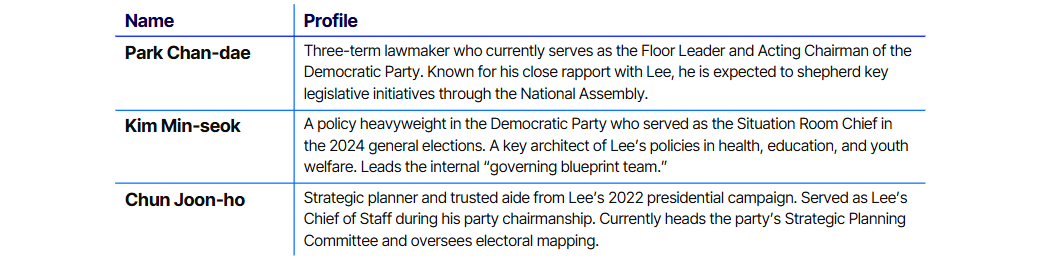

New Pro-Lee Bloc

These figures rose to prominence during leadership contests and policy battles. Their loyalty and alignment with Lee have made them central to the governance of the party.

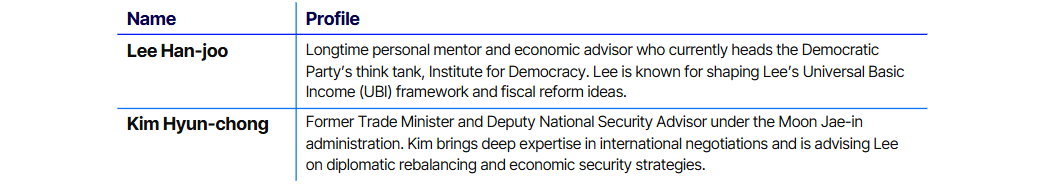

Policy Experts and Strategic Advisors

This group comprises long-standing mentors and technocrats to turn vision into programs, particularly in economics, trade, and foreign policy.

Materials presented by Edelman's public & government affairs experts. For additional information, reach out to Sean.Kwon@edelman.com or SB.Jang@edelman.com