Australia’s 2025 Federal Election: Labor’s Commanding Victory & Populism’s Defeat

At a Glance

On May 3, Australia’s 2025 Federal Election delivered a resounding mandate for the Australian Labor Party (ALP), which secured at least 93 of 150 seats—its largest victory since Federation and a rare second-term expansion of parliamentary strength. The outcome affirms strong public confidence in Prime Minister Anthony Albanese’s leadership and provides a clear mandate for progressive, centrist governance. For businesses, it signals a stable and reform-focused policy environment, with significant potential for delivery on trade, including multilateral agreements, climate, infrastructure, housing, and economic transformation.

At the same time, the Liberal–National Coalition collapsed to around 40 seats, suffering its worst result in post-war history and losing key urban and suburban footholds—including Opposition Leader Peter Dutton’s own seat of Dickson. Independents expanded their influence, while the Greens were reduced to a single seat in the House of Representatives and, like the Coalition, lost their leader. Meanwhile, far-right populist parties failed to gain ground, highlighting voters’ preference for competence, consensus, and practical reform over ideological division.

What Does This Mean for Business?

- Certainty with a Reform Tailwind: Labor’s decisive majority and Senate alignment with the Greens allow for stable governance and faster delivery on housing, energy, and skills development.

- Heightened Expectations from Society and Government: Public focus on cost-of-living, housing affordability, and climate action will shape regulatory and fiscal shifts. Businesses will face higher expectations to contribute visibly to national outcomes.

- Early Engagement, Strategic Alignment: With a unified government agenda, businesses that partner on key reforms, from clean energy to workforce transition, will be best positioned to shape outcomes and secure long-term operating confidence.

- Advocacy Over Bargaining: Investment and effort must focus on building relationships through advocacy, rather than bargain driven lobbying, for positive outcomes. Evidenced-based policy, rather than playing crossbench politics, will be key to success.

The Voting Mechanics: Australia’s Electoral Framework

Australia’s federal elections feature compulsory preferential voting:

- Lower House (House of Representatives): 150 members elected from individual constituencies; voters rank candidates by preference.

- Upper House (Senate): 76 seats filled via proportional representation with state-wide voting; half of the Senate seats are typically up for election.

This system rewards broad, centrist appeal and alliance-building, traits that underpinned Labor’s strong showing.

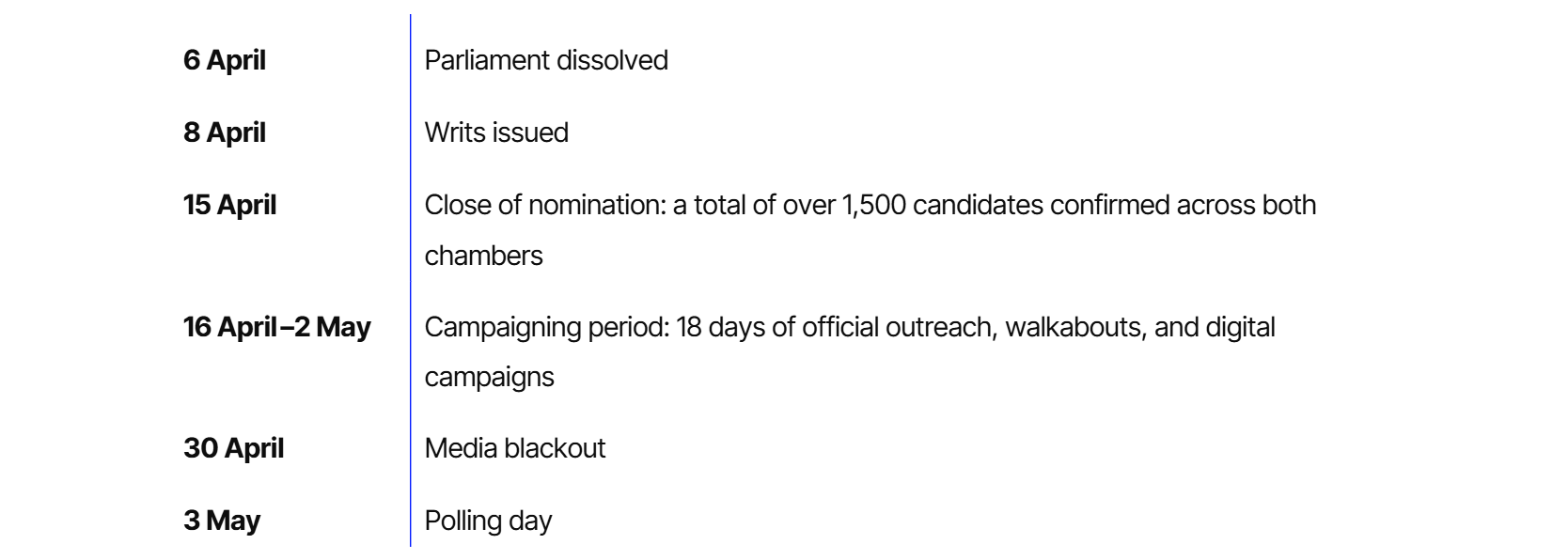

Timeline of the 2025 Australian Federal Election

Campaign Landscape: Message, Momentum, and the Albanese Method

The election campaign was short, strategic, and unusually consequential. Prime Minister Albanese formally called the election in early April, giving parties just under a month to contest what would become one of the most ideologically defined campaigns in recent memory.

Labor’s approach was clear: campaign on stability, cost-of-living relief, housing affordability, and the clean energy transition—all with a calm, centrist tone. Treasurer Jim Chalmers’ budget, delivered just weeks before the election, underlined this strategy, combining fiscal restraint with targeted social investment. Labor candidates focused heavily on suburban and regional seats, with tailored messages for young renters, families struggling with rising prices, professional women and dual income family workforce flexibility, and older Australians concerned about aged care and Medicare sustainability.

In contrast, the Liberal-National Coalition, led by Peter Dutton, took a more combative stance. Its messaging veered heavily toward culture-war themes, attacking “woke” institutions, immigration policies, and gender diversity initiatives-many political commentators labelled Peter Dutton “Temu Trump.” These positions failed to energize the base and alienated urban moderates, particularly women and younger voters. The Coalition’s economic offering was widely perceived as vague and reactive. A swing of ~4.5% two-party preferred (2PP) vote against Coalition and to Labor was seen as a repudiation of the importation of MAGA, reactionary conservatism to Australia, mirroring the result of the Canadian Election week prior.

Labor’s targeted campaigning in key marginals like Deakin (VIC), Boothby (SA), and Bonner (QLD) proved highly effective. Ground campaigns emphasized Albanese’s steady hand and contrasted it with Dutton’s divisive image. Independents and Teal candidates largely held their ground, whereas the Greens maintained their Senate foothold while losing most of their Brisbane and Melbourne inner-city lower house contests, including their leader’s seat.

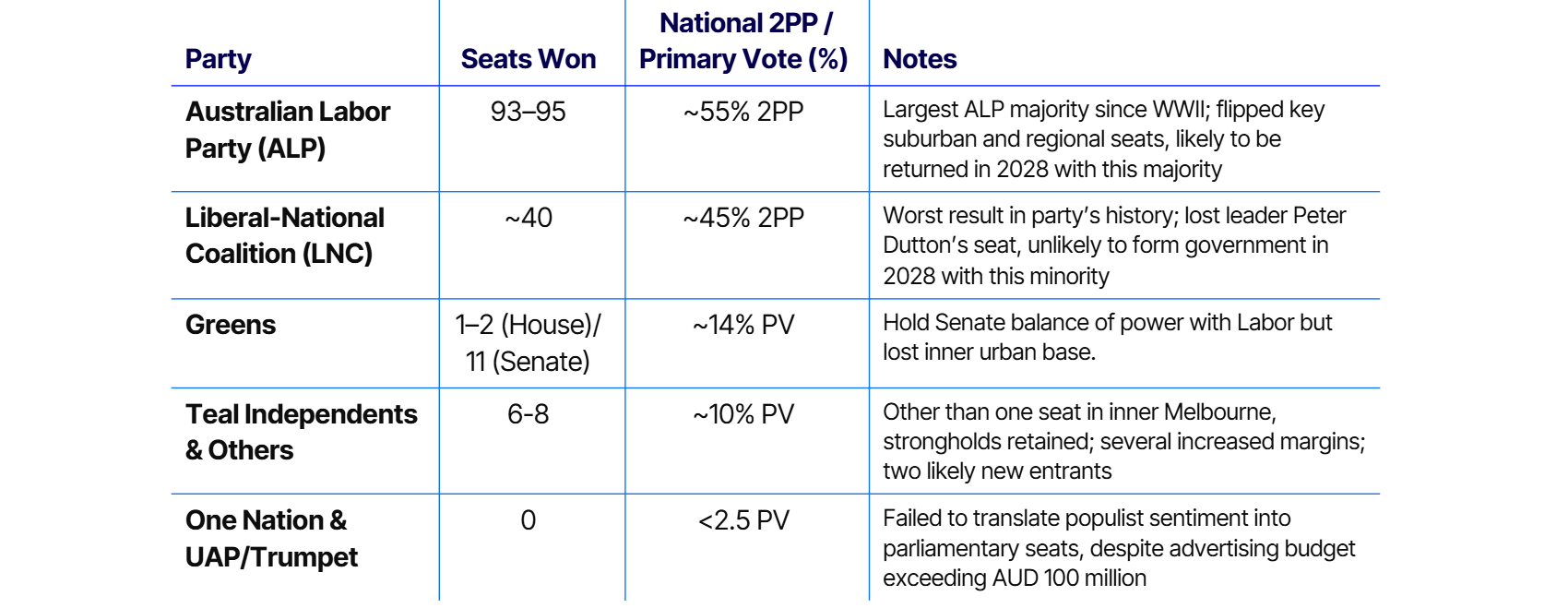

Election Results: A Broad Contest with Decisive Outcomes

Results were declared swiftly on the evening of Saturday, May 3, with the Australian Electoral Commission confirming a decisive majority for the Australian Labor Party (ALP) by early hours on Sunday. The two-party preferred (2PP) vote landed at approximately 55–45 in Labor’s favor, affirming months of polling and delivering one of the most commanding electoral results in modern Australian history.

Labor’s Commanding Victory: Breadth and Discipline Paid Off

The result marked a landmark moment for Prime Minister Anthony Albanese, who led Labor to a second-term expansion of seats—a rare feat in Australian politics. The ALP’s mix of centrist discipline, policy clarity, and ground-level execution flipped crucial battlegrounds, including:

- Traditional liberal seats in suburban Adelaide, Brisbane, Melbourne and Sydney, such as Deakin (VIC), Boothby (SA), Bonner (QLD), and Dickson (QLD) from the Liberals

- Labor capturing three of the four Greens lower house seats; Griffith (QLD), Brisbane (QLD), and Melbourne (VIC)

- Notable swings, and in some cases very sizeable swings to the government across outer-metropolitan belts in Brisbane, Melbourne, and Sydney, as well as professional and wealthier regional cities, such as Gilmore (cities of Nowra and Batemans Bay, NSW), Lecihhardt (city of Cairns, QLD) and Bass (city of Launceston, Tasmania)

- Largely holding all metropolitan Perth seats (WA)

- Enabling Labor to gain one Senate seat in each State at the expense of the Coalition.

Labor’s campaign avoided polarization, sticking instead to a message of economic stewardship, clean energy transition, housing reform, and aged care. Many political commentators described the PM’s persona and campaign style as dull, boring and safe, which translated to “conservative” with the majority of voters in an uncertain world (compounded by the timing and nature of the Trump administration’s Liberation Day tariffs). The swing in support reflected voter fatigue with political chaos and a preference for moderation over ideological theater.

Coalition Collapse: A Party Room Shrinking from the Center

The Liberal–National Coalition recorded its lowest-ever seat count and was all but erased from inner and middle suburban Australia. Particularly damaging was the personal loss of Peter Dutton, whose 18% swing in Dickson not only cost him the seat but also sent a message about the public’s rejection of his Trump-style culture war politics.

- The Coalition lost further ground in nearly every major capital except parts of Perth.

- Appeals to “anti-woke” sentiment and nationalism failed to resonate beyond hard-right circles.

- Urban, female, and younger voters abandoned the Coalition en masse.

Further, there is a risk that over the next 12 to 24 months the Coalition may well fragment into its constituent parts: the Liberal Party of Australia (all of Australia except QLD and NT, largely urban), The Nationals (largely NSW and VIC, some regional and mostly rural), the Liberal National Party (QLD only), the Country Liberal Party (NT only), NationalsWA (WA, have been in coalition with both the Liberals and Labor), noting that the Nationals have no presence in Tasmania and the NT and limited, if any in SA. Such fragmentation, accompanied by factional infighting would severely impact the ability of the Coalition to hold the government to account as an effective opposition and is likely to limit the Coalition’s ability to successfully campaign at the next election (late 2028) and possibly the election after that (2031). It is likely the Coalition will fragment into four main groupings: urban, rural, social progressives/economic conservatives and social/economic “hard” conservatives (likely influenced by MAGA).

Greens Hold Senate, But Lose House

The Australian Greens, led by Adam Bandt, lost three of their four lower-house seats—including that of their leader—but remain pivotal in the Senate with 11 seats. Their performance was strongest in:

- Primary vote in inner-city Melbourne and Brisbane, but lost seats due to preference flows

- Among under-35 voters, renters, and students

- The anti-nuclear fraternity, which remains strong amongst Cold War generation Baby Boomers and Gen X.

While their lower house loses were significant, their Senate leverage has increased (as with the government’s increased seats in Senate, the government no longer requires support of independents and micro-parties to pass legislation), giving them a central role in shaping climate, housing, and education legislation.

Teal and Independent Success: Integrity Still Resonates

The Teal independents, most of whom first broke through in 2022, consolidated their positions:

- All but one (Goldstein, VIC) retained their seats, with increased margins in many.

- Campaigns focused on centrist-focused climate policy, women’s safety, and political accountability.

- Their continued success points to a sustained appetite for non-partisan local representation.

- They expanded the diversification of their electorate, from the wealthiest urban areas in the country (Wentworth and Waringah, NSW), to the capital city suburbs (Bean, ACT), regional cities with rural hinterlands (Calare, NSW), and vast, remote electorates (Indi, VIC).

One notable shift: The Liberal Party reclaimed at least one Teal-held seat, where the incumbent was seen as underperforming and over-reliant on brand recognition.

Minor Parties and Far-Right Flop

The far-right minor parties, including Pauline Hanson’s One Nation and the rebranded Trumpet of Patriots (formerly UAP), failed to win lower house seats or expand their Senate influence. Despite noisy campaigns and frequent social media presence, their vote share declined from 2022 levels. The electorate’s verdict was clear: populism without credibility has no traction in contemporary Australia.

An Electoral Shift with Global Echoes

Australia’s 2025 election result reflects trends in many other Western democracies: voters gravitate toward competence, stability, and moderation rather than ideological conflict. The magnitude of Labor’s victory and the Coalition’s collapse indicate a new electoral consensus—one defined less by left-right polarity and more by a rejection of polarization itself.

Democracy is not Cheap

In the 2025 federal election, more than 110 candidates—primarily from minor parties and independents—lost their election deposits after failing to reach the 4% first-preference vote threshold in their respective House or Senate contests.

At AUD 2,000 (~USD 1,320) per candidate, this represents an estimated AUD 220,000 (~USD 145,000) in forfeited deposits—a costly reminder that in Australian democracy, low visibility and scattergun messaging can come with a price tag.

Most of these candidates represented fringe or far-right populist parties, including several aligned with anti-vaccine and anti-immigration platforms. Their electoral performance highlighted a broader trend: Australian voters rejected imported culture wars and rewarded credible, community-rooted, centrist candidates.

Strategic Outlook for Businesses

While the 2025 federal election was not explicitly fought on a business platform, its outcome directly affects the private sector, particularly regarding policy stability, reform velocity, and alignment with government priorities. The scale of Labor’s win offers businesses both predictability and an intensified imperative to engage with an increasingly confident federal agenda.

1. The government’s majority will deliver stable policy and faster reform.

The Albanese government’s return with an expanded majority and effective Senate working control (with the Greens) means legislative delivery is now unimpeded. Core economic settings—pro-enterprise, trade-oriented, and fiscally moderate—are expected to remain steady. However, reforms in housing, energy transition, and workforce policy are likely to accelerate with fewer political constraints. Echoing the PM’s election slogan: no one held back, no one left behind.

- The government is expected to double down on clean energy investments, critical minerals development, housing supply programs, and diversification of trade through multilateral agreements (e.g., the Trans-Pacific Partnership) and bilateral agreements (e.g., Australia-European Union Free Trade Agreement) to reduce exposure to the Chinese market and risk of the US market.

- Continued industrial and digital transformation will be a policy priority, particularly in renewables, cybersecurity, and domestic manufacturing.

For businesses, this presents a high-certainty environment for long-term investment but also higher expectations for alignment with national policy objectives. Businesses will be expected to contribute to the “commonwealth.”

2. Cabinet appointments will reveal the pace and direction of reform.

Cabinet appointments and early ministerial statements will provide signals on reform emphasis across key sectors. Developments to watch include:

- Factional shifts in representation: A realignment within the Labor Caucus—favoring the Labor Left over the Labor Right—may influence individual ministerial priorities but is unlikely to alter the whole-of-government agenda.

- Economic and industry portfolios: New ministerial leadership could accelerate action on local supply chains, ESG reporting frameworks, and investment incentives tied to decarbonization.

- Skills, employment, and migration: Policy recalibration is expected in skilled migration pathways, vocational training, and AI-readiness—particularly to address productivity and demographic pressures.

- Climate and housing: Dedicated ministries may adopt more assertive positions on building approvals, emissions disclosure, and social equity in urban planning.

- Economic growth and budget repair: To offset the structural deficit from rising social spending, productivity will take center stage. As the Treasurer stated, “while last term was about inflation and a little bit of productivity, this term will be about productivity and a little bit of inflation.”

3. Policy continuity will be matched by targeted regulatory pressure.

The Labor campaign clearly identified housing affordability, aged care, and cost-of-living as pressure points. Businesses in sensitive sectors—including retail, energy, finance, and property—should anticipate:

- More assertive regulatory settings (e.g., price transparency, supply-side accountability, competition policy and divesture of monopolies and crack-downs on collusion)

- Increased stakeholder engagement from ministers and regulators

- New grant programs, procurement frameworks, and obligations linked to ESG and public value.

While macroeconomic fundamentals will hold, microeconomic reforms will gather pace to reflect the Treasurer’s productivity agenda—requiring businesses to stay nimble, transparent, and socially credible.

Recommendations

With a high-capacity government and unified direction, the onus is on businesses to proactively engage and adapt. Forward-looking firms should focus on the following:

Engage proactively with decision-makers. Initiate early briefings with returning and new ministers, particularly in portfolios overseeing infrastructure, climate, skills, and competition. Articulate how your business contributes to national goals, with a focus on delivery and impact. Build trusted relationships.

Monitor reform signals and budgetary trajectories. Track the first 100 days closely—including the mid-year economic update and initial legislative packages. Watch for Treasury, Housing, and Climate-related signals in departmental briefings and public consultations. Productivity enabling policies will be key.

Build institutional readiness for public affairs. Ensure your organization is equipped to anticipate and respond to policy shifts:

- Integrate political and regulatory risk into enterprise risk frameworks.

- Embed government relations into strategic planning, especially ESG and capital allocation.

- Participate actively in policy consultations, industry roundtables, and parliamentary inquiries.

- Take this opening to reform market design for competitive advantage given stable, centrist and probably long-term government—at least two, if not three, terms).

Conclusion: Policy Certainty, Reform Urgency

The 2025 election result gives the Albanese government a clear runway to govern—and to develop and deliver centrist reform. For business, this is a moment of opportunity: to shape the national agenda, to lead responsibly, and to align visibly with a forward-facing, equity-driven Australian growth model.

Materials presented by Edelman Global Advisory Japan. For additional information, reach out to Nikole.Wong@edelman.com or Russell.Joshua@edelman.com