Top Five Issues to Keep on Your Radar Over the Holidays

Even as we look forward to unplugging over the holidays, we share with you a friendly reminder that geopolitics never rests. It was the 2019-2020 holiday season when an unknown “pneumonia” first started appearing in Wuhan, China. And the 2021-2022 holiday season was when Russia escalated its build-up of troops along the Ukraine border.

As we head into the holidays, here are the major geopolitical events that will be rapidly approaching after the New Year that we are encouraging clients to keep an eye on for potential risk to their brand and business.

1. Taiwan elections

On January 13, 2024, Taiwan will host its general election with three  main contenders for president—Lai Ching–te of the Democratic Progressive Party (DPP), Hou Yu-ih of the Kuomintang (KMT) and Ko Wen-je of the Taiwan People’s Party (TPP). The election is widely viewed as a referendum on the DPP’s leadership under current President Tsai Ing-wen, including the handling of COVID-19, the economy, and relations with the US and China. Each of these parties—and their candidates—take a different stance on Taiwan-China relations and, as such, the election outcome could have implications for the region and geopolitical landscape more broadly.

main contenders for president—Lai Ching–te of the Democratic Progressive Party (DPP), Hou Yu-ih of the Kuomintang (KMT) and Ko Wen-je of the Taiwan People’s Party (TPP). The election is widely viewed as a referendum on the DPP’s leadership under current President Tsai Ing-wen, including the handling of COVID-19, the economy, and relations with the US and China. Each of these parties—and their candidates—take a different stance on Taiwan-China relations and, as such, the election outcome could have implications for the region and geopolitical landscape more broadly.

No party wants conflict with China, but each does have their own view on the future of Taiwan’s relationship with China. The DPP is perceived to be the strongest advocate of Taiwan autonomy. Beijing, in turn, has refused to engage with the Tsai administration for the duration of her eight-year term, painting DPP leadership as separatists. Its candidate Lai Ching-te. currently vice president and the frontrunner—though with a narrowing lead—has affirmed he will carry forward President Tsai’s approach to cross-strait relations, among other policies. A DPP win would likely see a continuation of tensions with Beijing.

The traditional KMT party—polling in second—is known for its more pro-Beijing stance and is willing to engage in dialogue, which KMT leaders argue is the best way to maintain Taiwan’s interests and prevent conflict. The KMT is the party Beijing would prefer, but it has struggled to make headway with younger voters. The third party, the TPP is an upstart founded in 2019 by the former mayor of Taipei Ko Wen-je and is polling in third place. Ko has focused on domestic issues more than foreign policy but has not ruled out dialogue with China and has amassed significant support from young voters disenchanted with the KMT and DPP. While he is seen as a long shot for the presidency, his candidacy disrupts the two-party stronghold. It remains to be seen if the KMT and TPP can mount enough support to challenge the DPP—talks to form a united ticket fell apart in November after Hou and Ko failed to agree who would be on top of the ticket.

It will be important to watch how China reacts to Taiwan in the lead up to and following the elections, and how the US reacts in turn. Already there are signs Beijing is increasing economic pressure on industries in Taiwan. The Biden administration will be pressured to take a firm response to anything seen as provocative by China’s military in the region, but Biden is also interested in maintaining a floor in the fragile US-China relationship after his recent meeting with President Xi in San Francisco.

2. Iowa and U.S. 2024 elections

On January 15, Iowa’s Republicans will be the first nationwide to select their top choice for their party’s presidential nominee in the 2024 election, marking the kickoff to the US presidential elections. For the business community, the election season means an increasingly crowded media environment as political ads dominate airwaves and, in some cases, drive up media buying prices. The election year also brings heightened attention to politically adjacent corporate issues and crises that can place a brand in political crossfire.

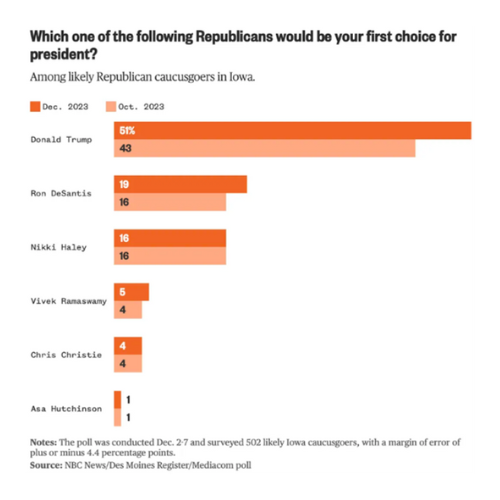

According to recent polling and leading polling averages, in Iowa President Donald Trump leads Governor Ron DeSantis, 51% to 19%—the biggest lead recorded in the poll’s history this close to the caucus. Ambassador Nikki Haley, who is focusing on a New Hampshire strategy, trails at 16%. Trump’s opponents—on both sides of the aisle—see Iowa as a crucial juncture in preventing him from becoming the GOP presidential candidate. National polls and the critical next primary state of New Hampshire have Haley leading DeSantis, while Trump is still ahead of her by 15% in most New Hampshire polls. Meanwhile, Colorado is also attempting to prevent a Trump nomination with the state’s Supreme Court decision to ban him from the state ballot—and we will be watching in the coming weeks to see if other states follow suit. The GOP is rallying against the decision claiming “election interference”—a show of unity that could further galvanize support for the former President heading into the primaries.

According to recent polling and leading polling averages, in Iowa President Donald Trump leads Governor Ron DeSantis, 51% to 19%—the biggest lead recorded in the poll’s history this close to the caucus. Ambassador Nikki Haley, who is focusing on a New Hampshire strategy, trails at 16%. Trump’s opponents—on both sides of the aisle—see Iowa as a crucial juncture in preventing him from becoming the GOP presidential candidate. National polls and the critical next primary state of New Hampshire have Haley leading DeSantis, while Trump is still ahead of her by 15% in most New Hampshire polls. Meanwhile, Colorado is also attempting to prevent a Trump nomination with the state’s Supreme Court decision to ban him from the state ballot—and we will be watching in the coming weeks to see if other states follow suit. The GOP is rallying against the decision claiming “election interference”—a show of unity that could further galvanize support for the former President heading into the primaries.

With less than a month to go, major Republican contenders are enhancing their ground games in Iowa, New Hampshire, South Carolina, Nevada, Michigan, and Idaho, expending time and resources to make a strong showing in as many of the first primary contests as possible. With Trump expected to continue to hold a large lead, the planned CNN January 10 debate between Haley and DeSantis is another chance for either one to lock up the position of becoming his main opponent. While Trump’s historic lead in the polls does not yet equate a victory in Iowa or the nomination, barring a primary upset or legal action rendering him ineligible for office, a 2024 Trump-Biden rematch—and all that means for the business and media environment—seems plausible.

3. UK politics

As in the US, migration is a live issue amid record high legal migration and the persistent challenge of illegal migrants and asylum seekers crossing the English Channel via small boats. Prime Minister Rishi Sunak’s inability to address the issue of illegal migration has fueled tensions within the government and wider Conservative Party, exposing many of the fault lines between the party’s moderate and populist wings.

These tensions erupted into the open after the UK  Supreme Court found the government’s policy of deporting asylum seekers to Rwanda to be illegal and then the government introduced emergency legislation—the Rwanda Bill—to address that ruling. However, Immigration Minister Robert Jenrick, previously seen as a close Sunak ally, unexpectedly resigned in early December as he did not believe the Rwanda Bill went far enough to ensure the policy could be implemented. In the end, most “rebels” abstained, allowing the bill to pass. However, this is only a “Christmas truce,” as the bill will return to the Commons in mid-January. At this stage, MPs will be able to table amendments and we can expect rebels on the party’s populist wing to try to further toughen the legislation.

Supreme Court found the government’s policy of deporting asylum seekers to Rwanda to be illegal and then the government introduced emergency legislation—the Rwanda Bill—to address that ruling. However, Immigration Minister Robert Jenrick, previously seen as a close Sunak ally, unexpectedly resigned in early December as he did not believe the Rwanda Bill went far enough to ensure the policy could be implemented. In the end, most “rebels” abstained, allowing the bill to pass. However, this is only a “Christmas truce,” as the bill will return to the Commons in mid-January. At this stage, MPs will be able to table amendments and we can expect rebels on the party’s populist wing to try to further toughen the legislation.

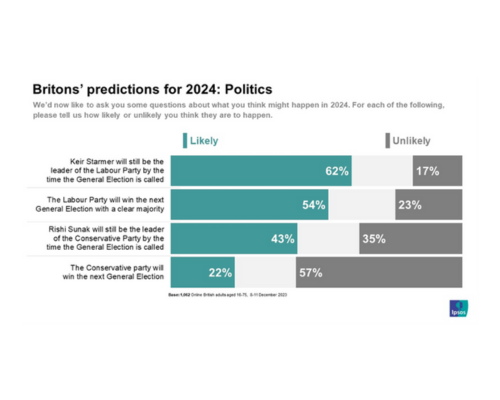

The Rwanda Bill is only one of many headaches for Sunak with his personal approval rating hitting a record low of –49 last week amid the ongoing cost-of-living crisis. There will also be another by-election in a Tory-held seat after an MP was forced out over allegations of sexual harassment. Under Sunak, the party has already lost four out of five such contests with each defeat making Tory MPs more nervous as they are facing not only defeat but a potential wipeout at the upcoming general election.

As such, speculation is mounting around a potential attempt to force Sunak out. The idea of four UK Prime Ministers in a single parliamentary term would previously have been considered outlandish, but volatility has become the new normal in UK politics. If clashes over the Rwanda Bill tip the party into all-out civil war again, this could force a vote of no confidence in Sunak and another leadership contest. While clearly far from ideal, the thinking in the rebel camp would be that any potential successor would still have the best part of a year to try to turn the party’s fortunes around.

With Sunak announcing this week that general elections will be held in 2024 and with polls consistently giving Labour a lead of around 20 points, something dramatic would have to happen to prevent Labour’s Keir Starmer from entering Number 10 next year after 14 years of Tory rule.

4. Conflict in the Middle East and the global economy

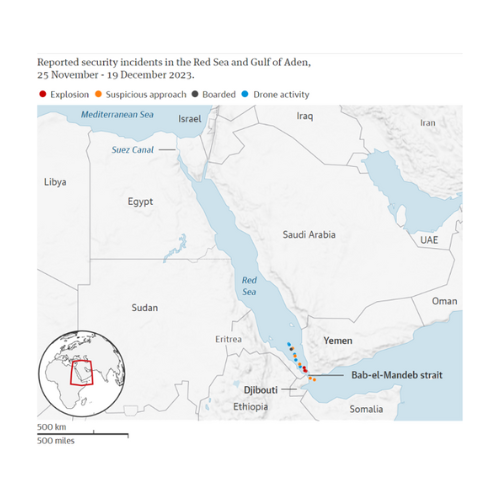

As the Israel-Hamas conflict continues, militant groups across the region have stepped up attacks against Western targets, threatening global economic interests in the near-term. Over the past month, attacks by Yemen’s Houthi rebels on commercial fleets in the Red Sea are forcing shipping companies to reroute their merchant traffic away from the Bab-el-Mandeb Strait, a logistics chokepoint that facilitates over 10% of global commerce. Thus, many ships will have to travel around Africa’s Cape of Good Hope, adding nearly two weeks of travel, causing global supply chain frictions and increasing consumer costs. A long-term disruption of traffic through the Red Sea would impact energy prices—as oil accounts for one-fifth of the traffic through the Suez Canal—and increase the financial burden on countries that depend on the Suez for trade.

In response to increased attacks, the US Defense Secretary announced Operation Prosperity Guardian, a coalition of mostly NATO nations mobilizing to render the Bab-el-Mandeb Strait and the Red Sea safe again for commercial passage. The coalition’s forward posture in the region, however, further exposes it to risk of attack and being drawn directly into the conflict, potentially broadening the Israeli-Hamas war and putting the US and Iran in direct conflict.

In response to increased attacks, the US Defense Secretary announced Operation Prosperity Guardian, a coalition of mostly NATO nations mobilizing to render the Bab-el-Mandeb Strait and the Red Sea safe again for commercial passage. The coalition’s forward posture in the region, however, further exposes it to risk of attack and being drawn directly into the conflict, potentially broadening the Israeli-Hamas war and putting the US and Iran in direct conflict.

Beyond the horrific destruction of lives and livelihoods in the region, the economic toll continues to add up as well. Jobs have vanished and investment and growth in the region plummeted. Jordan, Egypt, and Lebanon especially are struggling, with combined GDP loss estimated at over USD 10 billion. The lagging tourism industry will also hit these three states particularly hard, just as they were regaining their footing after the pandemic. Now, threats to global shipping routes will also have broader impact on struggling regional and global economies.

In a positive signal for the global economy, US Federal Reserve Chairman Jerome Powell recently moved markets in his speech relaying the end of rate hikes—Goldman Sachs is now expecting three consecutive cuts of 25 basis points in March, May, and June. In the long term, interest rate cuts would provide a boost to the global economy, providing relief on debt servicing for governments and lowering borrowing costs for consumers on home mortgages, credit cards, and car loans. The cuts could also boost company valuations, potentially helping fuel returns for stockholders as well as re-stimulating M&A deals. March, however, is still far away and ongoing conflict in the Middle East, especially with deepening US involvement, could undermine rate cuts before they get here.

5. Black Swans

Even as we remind readers that geopolitics never rests, we also note that we should be expecting the unexpected. In recent memory, we have seen unpredictable and unprecedented events—the pandemic, military conflict, extreme weather events—play out at unexpected times, reminding us of the volatility of geopolitics and its high impact on the business and media environment. Risk assessment and strategic planning are more important than ever.

Given the volatile political, economic, and military issues unfolding around us, here are examples in which scenario planning can help companies see around corners, prepare for the worst, and achieve their best:

- Supply chain disruptions as a result of conflict in the Red Sea or Taiwan Strait

- Energy supply shocks due to escalating conflict between Israel-Hamas or Russia-Ukraine

- Further global economic slowdown caused by domestic instability in a major economy

- Heightened geopolitical tensions over conflict in South America or East Asia

- Critical infrastructure failures as a result of state-sponsored cyberattacks

While black swans are, by definition, unpredictable, they are to be expected. Over the holidays, we encourage you to keep an eye on political developments in Taiwan, the US, the UK and conflict in the Middle East, each of which pose unique risks for businesses and brands. And looking ahead to 2024, consider how scenario planning could help better position your business for long-term success.