South Korea Elections Primer: What to Know Before April 10

At a Glance

- On April 10, 2024, South Korea will hold General Elections for its National Assembly. With the Blue House held by the ruling People Power Party (PPP) President Yoon Suk-yeol, and the National Assembly controlled by a formidable opposition Democratic Party of Korea (DP) bloc, the electoral landscape is characterized by intense partisanship and threats of gridlock.

- As a midterm election, campaigning has focused on scrutiny of incumbent President Yoon’s performance, and election outcomes are poised to significantly influence the legislative agenda of Yoon’s remaining term. While Yoon suffers from a dismal approval rating, growing public discontent with both parties over partisanship and gridlock will ameliorate a trouncing for the PPP.

- The opposition DP is anticipated to retain their legislative majority despite projected losses for the PPP. This might bode well for Yoon’s policy agenda with a slightly less foreboding opposition majority in the National Assembly.

South Korea General Elections 101

The 22nd General Elections in South Korea will take place on April 10, 2024, with a total of 300 unicameral National Assembly seats up for grabs. At the midterm of embattled President Yoon Suk-yeol’s tenure, the elections are coming at a critical juncture of rising public discontent with his administration and gridlock within the National Assembly.

The National Assembly is currently controlled by the opposition Democratic Party of Korea (DP), which holds a record high of 180 seats across its affiliates bloc. The People Power Party (PPP), which is also President Yoon’s party, presides over a minority and tenuous conservative coalition. With its majority, the DP has presented a significant obstacle to President Yoon’s legislative agenda, blocking progress on issues such as healthcare reform, revamping the real estate market, and “normalizing” the trade and diplomatic relations.

The current elections are also marked by growing voter disillusionment over the revolving “two-party” system of the PPP and DP, whose partisanship has injured any effective policy achievements. This disillusionment has yielded growing support for minor parties formed by breakaway high-level defectors from the two parties—usually led by influential former and current public figures. Should breakaway parties succeed in stealing enough votes, they could play kingmaker and be a thorn at the side of Yoon’s remaining term.

The ruling PPP, whose name has changed over decades of mergers and rebrands, draws consistently from conservative, pro-business, and pro-US voters, unlike the DP, which generally draws from liberal, pro-labor, anti-Japan, and pro-China voters. In the revolving nature of Korea’s party systems, youth voters are a critical swing voter bloc whose elusive turnout can make or break elections.

Breakaway parties also play a growing role in Korea’s political system and now gain a critical advantage from the newly established hybrid electoral process since 2020. While 254 of the 300 seats are constituency seats elected directly as first-past-the-post, the remaining 46 seats are allocated by a proportional representation system based on party list. This benefits popular smaller parties who would have otherwise not gained seats in a purely first-past-the-post system.

The elected members of the 22nd National Assembly will assume their responsibilities for a four-year term spanning May 30, 2024, to May 29, 2028.

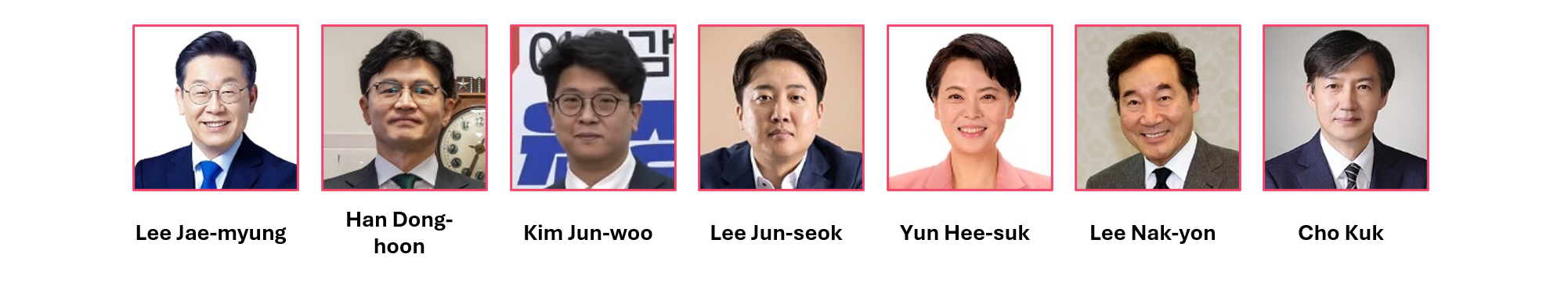

Contesting Parties and Their Leaders

- Parties and Leadership in the Electoral Contest

- Democratic Party of Korea (DP): Lee Jae-myung (Leader)

- People Power Party (PPP): Han Dong-hoon (Interim Leader)

- Green Justice Party: Kim Jun-woo (Leader)

- New Reform Party: Lee Jun-seok (Leader)

- Progressive Party: Yun Hee-suk (Standing Representative)

- New Future Party: Lee Nak-yon (Leader)

- Rebuilding Korea Party: Cho Kuk (Leader)

Policy Priorities of Major Parties

With the world’s lowest birthrates, the dual crisis of fertility and aging is a major policy issue pressing both parties, who have offered similar work-life balance and elderly welfare solutions. The difficult global economic outlook has also seen shared policy points of support for industries and corporations, although they diverge in approaches to implementation of industrial policy and economic stimulus. Addressing climate crisis has also remained as one of the key target areas for both parties, where they both share similarities in touting state-led projects towards green economy transition and green growth.

The PPP's key policy agenda includes a healthy work-life balance, accommodating childcare services amid a fertility crisis, public safety, reviving startups, and addressing climate change. The party has mostly sought to upkeep the existing status quo of measures with minor tinkering and applying regulatory pressure on corporations to ensure better working conditions for those with children.

The DP has also put forward pledges to tackle the low birthrate, assuring the basic quality of life, and responding to the climate crisis. They diverge, however, in further pledges on achieving major reforms to the political system. Foreign policy is another key area of divergence—balking at the peace overtures that Yoon has made to Japan (Korea’s old colonizer), the Democrats have vowed to pursue a tougher line on diplomatic relations with Japan. Meanwhile, the Democrats have sought a return to a Sunshine Policy of de-escalation and rapprochement with North Korea. This is much in keeping with Yoon’s Democratic predecessor, Moon Jae-In, and an era of landmark dovish North-South Korea relations.

Despite these campaign pledges, a lack of financing details has yielded criticism of both parties as being unrealistic. The PPP has proffered financing through continuous adjustment of expenditure structure for government-led projects, an approach echoed by the DP which has suggested that expenditure be met by expected increases in government revenue. Korea’s budget ran at a deficit during the Covid-19 years, but the country has a history of fiscal discipline and Yoon’s administration has since tightened spending.

Key Battlegrounds and Their Strategic Importance

Seoul, Incheon, and Gyeonggi province, which comprise the greater capital region, are considered the key battlegrounds, as the province and municipalities account for more than half of the country’s total population. The three areas will elect 122 lawmakers in the upcoming elections and many of Korea’s political heavyweights come from these regions.

Gyeonggi province is considered the most pivotal swing battleground of the three, as it holds the greatest number of available seats at 60 out of 300—a hefty 20% of the total. The Democratic Party of Korea achieved a landslide victory in the 2020 General Elections securing 51 of the 59 Gyeonggi seats then. As a DP stronghold, the province is now shaping up to be a focal point of campaign efforts, with the People Power Party intensifying its campaign efforts in an attempt to regain influence in this critical region.

Anticipated Outcomes and Strategic Implications of the 22nd General Elections

A Chilly Midterm Evaluation of Yoon Suk-yeol

The president’s approval rating is a significant indicator in forecasting Korea’s midterm election outcomes, setting the electoral mood for either continuity of policy or rebuke of the incumbent administration. Typically, if the president’s approval rating dips below 35% while disapproval exceeds 55%, the public’s push for rebuke overshadows all other election themes.

Yoon and his party face a frigid Korean public amid scandals around Yoon’s wife, family, ministerial cabinet, and close associates. The scandals, including bribery, also run directly counter to Yoon’s 2022 campaign promises of justice in the scandal-prone Korean politics. This has contributed to a meager approval rating for Yoon in the 40% range over the last three weeks. But in a significant and worrying development for the PPP, the latest poll shows approval ratings have dipped into the dangerous 30% range. And as disapproval ratings are rising, the public mood seems ripe for rebuke.

Muddy Waters and Black Swans

Even as the PPP reels from scandal and failed promises, approval ratings for the DP has also withered under PPP criticism for its performance as majority leader of the legislative branch. This fierce partisanship has ultimately damaged both parties significantly, giving ground to smaller parties.

As with previous elections, black swan events in the last few days of a campaign can lead to unexpected defeat. In the 2016 General Elections, factional in-fighting in the New Frontier Party (now the People Power Party) late in the campaign contributed to an upset, despite the party’s lead in opinion polls. In other cases, controversies in nominations for ministerial posts or pejorative hot mic comments have tanked campaigns. While the prospect of late-campaign factionalism or ministerial controversies appear unlikely, the nature of black swans mean the unexpected is always possible.

Sustained DP Majority, Albeit Weaker

While the opposition DP is anticipated to hold its majority in the National Assembly, its majority could shrink from its current dominant 180 seats (including seats from its then-satellite party). An internal party assessment suggests that it could still reach as high as 153 seats this election, from both constituency votes and via the proportional representation system. Though a shrinking majority and a far cry from its miraculous landslide in 2020, the DP recognizes this outcome would still be a Democrat victory.

Meanwhile, the ruling PPP anticipates securing around 110 seats—slightly up from its current 103 seats—even despite the dismal presidential approval ratings. These results, if realized, would effectively translate to a continued DP majority in the legislative branch—albeit humbled. Unlike the previous four years, the DP would no longer be able to push ahead its agenda on a whim.

Yoon is likely to continue to face a formidable level of legislative hurdles. But his PPP would now hold enough seats to exert control over major sub-committees, thus offering a much better beachhead for his legislative agenda. And compromise, rather than the hatchet, will have to mark DP-PPP relations.

The impact of such an election outcome would also not be significant enough to threaten the remainder of Yoon’s tenure. Internal party politics, however, is a different ballgame: his place as top dog within the ever-fractious PPP will be all the more precarious, opening the door to upstarts and returning heavyweights.

Every Small Party Has Its Day

Korea’s new proportional representation system tends to favor small parties—to the chagrin and detriment of party titans the PPP and DP. In an effort to allow a more proportional seat share among Korea’s parties, its electoral system in 2019 started allocating 46 seats for proportional representation. Under this mechanism, the People Future Party—a satellite faction under the PPP—and the Democratic Union—a satellite union party under the DP and other politically progressive parties—are each anticipated to secure approximately 15 seats. Reformist alternatives, the Rebuilding Korea Party—a liberal party led by former Justice Minister Cho Kuk during the Moon Jae-in administration—and the New Reform Party—a conservative party led by former PPP leader Lee Jun-seok—are expected to gain about 10 seats and 2 seats, respectively.

The growing heft of these small parties in the National Assembly will not likely upend Korea’s revolving two-party system, nor do they actually offer much ideological diversity for Korean voters given their alignments with either of the main two parties. However, in the event of a hung parliament, where small parties play kingmaker, they could well leverage this to advocate on wedge issues, such as conservative gender issues in the case of the New Reform Party.

What Global Businesses Should Know

Policy continuity is expected. A weaker opposition Democratic Party majority in the National Assembly bodes well for continuity of Yoon’s policies. Notably, initiatives such as the sustained promotion and expansion of the nuclear power sector and related industries are expected to forge ahead, independent of electoral outcomes. As the two parties do not diverge on the dual crisis of fertility and aging population, policy measures and discourse in these areas will likely stay the course. But the devil could well still be in the details.

Compromise will also characterize the next few years. With more balance expected between the two parties in the Blue House and the National Assembly, as well as mounting public discontent with partisanship, both parties are incentivized to meet in the middle. This would be a welcome relief to the threats of gridlock that marked Yoon’s administration.

Partisan politics will mark the regulatory and policy development process. The business sector should account for the partisan lay of the land in approaching regulatory and policy development. Bills are enacted through the patchwork of a DP-majority National Assembly but are ultimately undertaken and implemented by ministries and government bodies who answer to a PPP-controlled executive. A deep understanding of the two political blocs is essential for effective government and regulator engagement in policymaking and the day-to-day.

This content offers a high-level synopsis of current events. It is intended to provide information only, not opinion, and it is not representative of any specific EGA work.

Amid Korea’s dynamic business and political environment, global companies benefit from government affairs and business advisory services. A best-in-class advisory firm, EGA is well-embedded in Korea’s political ecosystem while offering regional and global lenses. We provide comprehensive analysis tailored to specific industries to help clients navigate DP and PPP policy implications and partisanship hurdles. For additional information, please reach out to Richard Andrew at Richard.Andrew@edelmanEGA.com or Huan Hwang at Huan.Hwang@edelmanEGA.com.