The Philippines’ 2025 Midterm Elections: Coalition Holds & Reform Rises

On May 12, the Philippines’ midterm elections reaffirmed the DuterTen coalition’s grip on power, with at least five Senate seats secured. The defections of Imee Marcos and Camille Villar to the Duterte camp further solidified this bloc’s dominance, signaling fluid allegiances and the growing visibility of the Marcos-Duterte split. For businesses, this means continuity in policy direction, especially across infrastructure and digital transformation.

In a dramatic twist, former President Rodrigo Duterte, despite being detained and facing ICC charges, won the Davao City mayoral race. His win highlights enduring grassroots loyalty and confirms that his influence remains deeply embedded in Mindanaoan politics.

Meanwhile, reformists Bam Aquino and Kiko Pangilinan staged strong Senate returns, echoing public demand for accountability and inclusive growth. A more diverse party-list outcome also underscored voters’ growing appetite for sectoral voices and reform-minded leadership.

In response to poor midterm results, President Marcos called for the resignation of all Cabinet secretaries on May 22 in a move framed as a “bold reset.” While economic officials were retained, key exits—including Foreign Affairs Secretary Enrique Manalo and Environment Secretary Toni Yulo-Loyzaga—signaled a strategic reshuffle aimed at reviving waning public support and reasserting control heading into the administration’s second half.

What does this mean for business?

- Stability with strings: Infrastructure and digital projects will move forward but expect tighter scrutiny and more complex coalition politics.

- Reform pressure is rising: Reformists are back. Expect calls for transparency, ESG compliance, and clear societal impact, especially in regulated sectors.

- Coalition engagement is critical: No one bloc dominates. Influence now requires building relationships across parties, committees, and sectors.

- Advocacy over access: Businesses must deliver value in terms of jobs, sustainability, and inclusive growth to remain credible and relevant.

Political Context & Electoral Framework

Pre-Election Political Landscape

The 2025 midterms were held at the midpoint of President Ferdinand Marcos Jr.’s six-year term. While his administration retained public approval on infrastructure and post-pandemic recovery, discontent was rising over inflation, governance, and internal political fractures. The rift between Marcos and Duterte loyalists, most notably exemplified by Vice President Sara Duterte’s public criticisms, complicated coalition cohesion.

Key fault lines included:

- The rift between Duterte loyalists and Marcos-aligned officials has deepened, particularly following public criticisms from former President Duterte and his daughter, Vice President Sara Duterte.

- The durability of the DuterTen coalition became more tactical than ideological, blending legacy Duterte populism with Marcos’ developmental nationalism.

- An emboldened yet fragmented opposition, led by returning figures such as Bam Aquino and Kiko Pangilinan, aimed to capitalize on the discontent among urban professionals, youth, and civil society.

Electoral System Overview

The Philippines operates under a mixed electoral system:

- Senate: Voters elect 12 candidates from a national pool through plurality-at-large voting. The 12 candidates who receive the most votes obtain seats, irrespective of party affiliation.

- House of Representatives: Comprises district representatives (elected via first-past-the-post in single-member districts) and party-list representatives, who constitute 20% of the chamber and are selected through proportional representation.

The Party-List System Act (RA 7941) mandates proportional representation for marginalized groups, ensuring smaller, sectoral voices are included in national lawmaking.

Significance of the 2025 Midterms

The 2025 midterm elections held heightened significance as a litmus test of President Marcos Jr.’s political capital and a key inflection point in the evolving post-Duterte order. Unlike previous cycles, this contest was marked by fluid allegiances, with notable defections, such as those of Imee Marcos and Camille Villar, reshaping traditional power alignments. It also served as a referendum on leadership style and institutional performance, with voters deciding between continuity rooted in populist loyalty and a renewed appetite for reform-oriented, issue-driven governance.

The surprise electoral victory of former President Rodrigo Duterte, despite his detention and ongoing international legal proceedings, further complicated the political landscape, underscoring the enduring strength of grassroots populism and the unpredictable nature of coalition dynamics.

The results suggest that while administration-aligned forces retained control, voter sentiment is increasingly fragmented, discerning, and responsive to credibility over charisma. These elections may well be viewed as a pivotal waypoint in the Philippines’ democratic evolution, foregrounding institutional maturity, coalition recalibration, and the early framing of the 2028 presidential contest.

Campaign Dynamics: Messaging, Momentum, and Maneuvering

The 2025 midterm campaign season was characterized by strategic endorsements, cross-coalition guest candidates, and competing visions of governance. The race unfolded as a contest not only between parties, but between political styles.

DuterTen and the Power of Familiarity

The DuterTen coalition, composed of Duterte-aligned stalwarts and select Marcos-backed candidates, focused on name recall, strongman branding, and populist continuity. Their messaging leaned heavily on themes of law and order, Overseas Foreign Worker (OFW) protection, and national sovereignty. Candidates such as Bong Go and Bato dela Rosa emphasized their proximity to the Duterte legacy, while newcomers like Camille Villar blended business acumen with youth-friendly platforms.

The Opposition’s Digital-First Outreach

Meanwhile, the reformist bloc, nicknamed “KiBam” after its leading figures Kiko Pangilinan and Bam Aquino, ran issue-based campaigns centered on education, good governance, and inclusive digital transformation. Bam Aquino’s tech-forward proposals and Kiko’s sustainability messaging resonated with young voters and civil society, particularly in urban areas and among the politically engaged middle class. Their digital campaigns were notably data-driven, leaning into social media micro-targeting and issue-based content.

Defections & Tactical Realignment

One of the most telling features of the 2025 race was the open defection of key figures from the Marcos camp to the Duterte coalition. Imee Marcos and Camille Villar, both previously aligned with President Marcos Jr., ran—and won—as guest candidates under the DuterTen slate. Their move underscored the fluidity of party lines in Philippine politics and revealed a strategic recalibration aimed at preserving political capital amid shifting public loyalties

The Role of Personality and Media Exposure

Name recognition and media visibility continued to play crucial roles. Television personalities like Erwin Tulfo benefited from sustained exposure and grassroots familiarity. Conversely, lesser-known progressive candidates struggled to gain traction despite their clear platforms and advocacy records, reaffirming the enduring influence of celebrity and dynasties in Senate races.

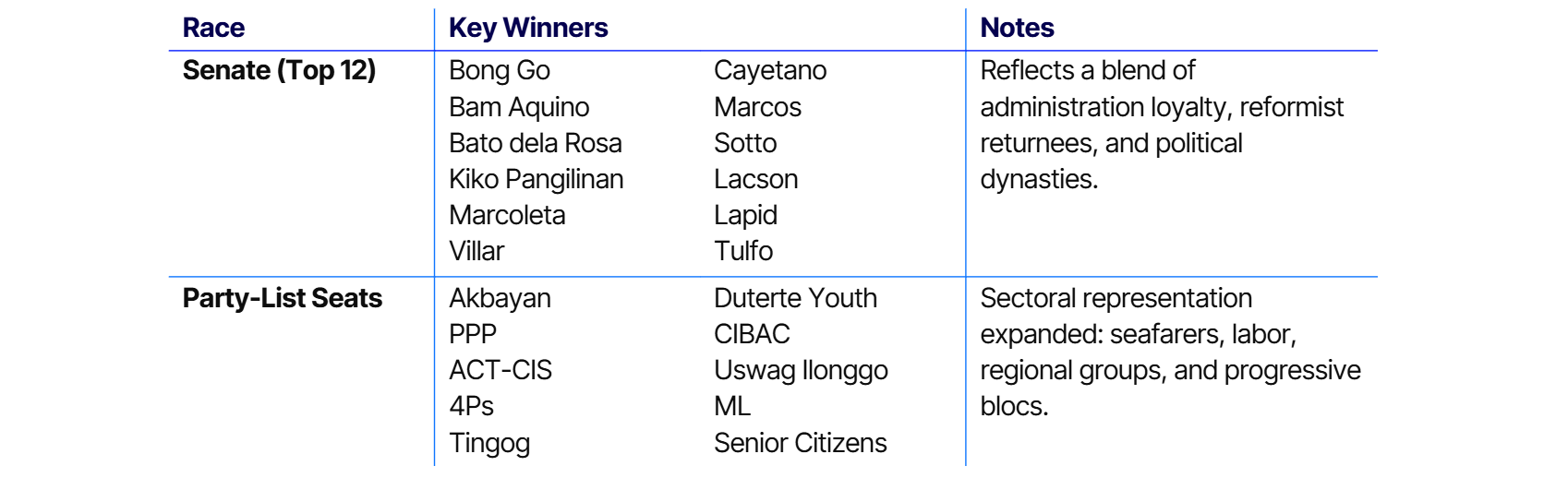

Election Results: A Fragmented Field with Familiar Faces

The results of the May 2025 Philippine midterm elections reveal a complex and nuanced mandate. While the Duterte-aligned DuterTen coalition retains a numerical advantage in the Senate, opposition figures made strong comebacks, and a diverse party-list slate secured representation across marginalized and regional sectors. The outcome signals a desire for continuity, tempered by selective reform.

Coalition Stability with Tactical Flexibility

The 12 contested seats in the Senate saw the Duterte-aligned DuterTen coalition maintain its position, winning at least five seats through loyalists such as Christopher “Bong” Go (first place), Ronald “Bato” dela Rosa (third place), and Rodante Marcoleta (sixth place). Their victories reaffirm the enduring appeal of Duterte-era narratives centered on order, nationalism, and grassroots welfare, particularly in areas beyond Metro Manila.

Duterte’s Enduring Influence from Detention

Despite ongoing detention and international legal proceedings, former President Rodrigo Duterte secured a decisive victory in the Davao City mayoral race, which underscores his lasting political capital, particularly across Mindanao. His win reinforces the grassroots strength of the DuterTen coalition and reaffirms Duterte’s symbolic hold over his core base. It also signals his potential to continue shaping national narratives and power realignments ahead of the 2028 presidential election.

Opposition Comebacks and Reformist Momentum

While the coalition’s strength endured, the strong performances of KiBam opposition figures Bam Aquino (second) and Kiko Pangilinan (fifth) signal a recalibrated appetite for issue-based governance focused on education, digital innovation, food security, and accountability. These results reflect a voter segment—largely youth, professionals, and civil society—seeking a Senate capable of oversight rather than merely rubber-stamping administration priorities.

Their return not only restores institutional reformists to the upper chamber but also introduces potential swing votes in legislative debates, particularly on issues such as inclusive growth, anti-corruption, and democratic safeguards.

Party-List Pluralism and Regional Assertion

The party-list race produced a diverse and pluralistic outcome. Progressive groups such as Akbayan and Mamamayang Liberal (ML) regained traction with their platforms of social justice and accountability. PPP (Puwersa ng Pilipinong Pandagat) emerged as a new representative for the maritime sector, occupying the space left by Marino Partylist, while Duterte Youth, ACT-CIS, 4Ps, and Tingog continued to excel among regional and grassroots voters. This outcome reflects growing public support for sectoral advocacy, regional empowerment, and niche representation, particularly in areas underserved by traditional district-based politics.

Legislative Landscape: Negotiated, Not Dominated

The new Senate is not monolithic. While the administration holds a working majority through its allies and guest candidates, the presence of returning independents and opposition figures ensures a more ideologically diverse and competitive chamber. Future legislative success will rely less on loyalty blocs and more on coalition-building around shared priorities, particularly in areas such as infrastructure, national security, digital innovation, and welfare.

Executive Reset: Reasserting Control Amid Legislative Fragmentation

In the wake of the midterm elections, President Ferdinand Marcos Jr. initiated a significant political maneuver by requesting the courtesy resignations of all Cabinet secretaries. This move, described by the administration as a “bold reset,” aimed to realign the government with public expectations following the administration’s underwhelming electoral performance. The elections, perceived as a referendum on Marcos’ leadership, saw only six of his endorsed candidates securing Senate seats, while allies of Vice President Sara Duterte and former President Rodrigo Duterte gained ground, signaling a shift in political dynamics. Analysts interpret this Cabinet overhaul as an attempt by Marcos to reassert control and address declining approval ratings, which have dropped to 25% according to recent surveys. The president emphasized that the reshuffle is about performance and urgency, stating, “This is not business as usual. The people have spoken, and they expect results—not politics, not excuses.” Notably, while key economic officials were retained to maintain policy continuity, the changes included the replacement of Foreign Affairs Secretary Enrique Manalo and Environment Secretary Toni Yulo-Loyzaga, reflecting a strategic recalibration within the administration.

Strategic Outlook for Businesses

The results of the 2025 Philippine midterm elections present a landscape of predictable continuity alongside emerging complexity. For businesses, this engenders both opportunity and obligation: to align with enduring policy agendas while preparing for more intricate stakeholder engagement across a fragmented legislature.

Anticipate continuity in infrastructure and regional investment. The administration’s ongoing commitment to infrastructure-led growth, through the Build Better More program, will remain intact. Senate support from Duterte-Marcos aligned lawmakers ensures legislative backing for flagship projects in transportation, digital infrastructure, and regional connectivity.

Businesses should anticipate:

- Continued rollout of big-ticket public-private partnership (PPP) projects.

- Incentives for regional expansion, especially in tourism zones, logistics corridors, and agribusiness hubs.

- Increasing scrutiny on sustainability and transparency, particularly in procurement and community impact.

Expect a new layer of reformist pressure. With the return of reform-oriented senators such as Bam Aquino and Kiko Pangilinan, expect heightened debate and oversight over issues such as:

- Digital transformation and innovation ecosystems

- Youth employment, education, and inclusive access

- Anti-corruption, transparency in public spending, and data governance.

While unlikely to derail administration priorities, these voices could shape public discourse, legislative amendments, and committee hearings, particularly in sectors like education, fintech, e-commerce, and agritech.

Leverage party lists for sectoral and regional policy gains. The diversity of the incoming party-list delegation presents tactical entry points for advocacy—especially in industries aligned with sectoral mandates:

- Maritime and logistics firms can engage PPP (Puwersa ng Pilipinong Pandagat) on seafarer welfare, port modernization, and maritime safety.

- Retail, Business Processing Outsourcing (BPO), and tourism sectors may find allies in groups like ACT-CIS, 4Ps, and Uswag Ilonggo pushing for jobs, consumer protection, and regional development.

- Sustainability-minded and ESG-focused companies should monitor progressive party-lists like Akbayan and ML for policy movements on human rights, climate justice, and green economy transitions.

Policy engagement will require nuanced coalition mapping. The Senate is now more fragmented and multi-voiced. Businesses must evolve from single-channel lobbying to multi-stakeholder coalition engagement. Strategic success will depend on:

- Building cross-coalition relationships across both administration allies and credible reformists.

- Anticipating committee-level action, especially in energy, ICT, education, and trade.

- Collaborating with sectoral champions from the party-list system to shape niche policy wins.

Expect ESG pressure and reputation risk management to rise. With opposition voices regaining seats and civil society representation returning to the House, businesses can expect:

- Greater visibility into corporate practices, particularly on labor, supply chains, and public-private partnerships.

- Rising pressure to demonstrate social value, not just profitability, especially in industries touching public welfare (health, transport, energy, agriculture).

- Heightened media and legislative scrutiny of cronyism, monopolistic behavior, and greenwashing.

What Comes Next

The Marcos administration sustains legislative momentum, supported by a cooperative Senate and key party-list allies. However, this is tempered by a noticeable undercurrent of reform, particularly from returning opposition senators and regional party-lists committed to governance and dignity.

For both business and civil society, the 2025 Philippine midterms were not just a test of political branding. It was a recalibration of trust, coalition strength, and institutional performance. Success in the years ahead will depend on navigating this multipolar environment with agility, credibility, and a clear sense of shared value.

Materials presented by Edelman's public & government affairs experts. For additional information, reach out to Daryl.Sim@edelman.com or Nikole.Wong@edelman.com