Japan’s Upper House election on July 20, 2025, marked a turning point in Japan’s political landscape. Minor parties, such as Sanseito and the Democratic Party for the People (DPP), gained visibility by channeling public frustration. Sanseito’s nationalist-populist rhetoric and the DPP’s economically pragmatic message illustrate divergent, yet reactive, appeals to voters alienated by mainstream politics. This memo breaks down the election results, profiles key emerging parties, explores the policy implications for foreign companies, and offers strategic guidance for navigating Japan’s increasingly pluralistic political terrain.

Key Takeaways for Business

- Rising Populism: Increased anti-foreign rhetoric may gradually weaken bipartisan support for foreign investment and open markets.

- Policy Volatility: Fragmentation increases risks of legislative gridlock and slower reforms—expect greater unpredictability.

- Diversify Engagement: Go beyond the LDP—engage with emerging parties, regional leaders, and reform-minded officials.

- Defense & Energy Opportunities: Cross-party support creates chances in cybersecurity & dual-use tech; supply chain resilience, as well as nuclear, LNG, and renewables.

- Local & Digital Strategies: Focus on pilot programs with innovation-driven local governments in healthcare, mobility, and infrastructure.

Election Results

Ruling Coalition Falls Short in Upper House Election

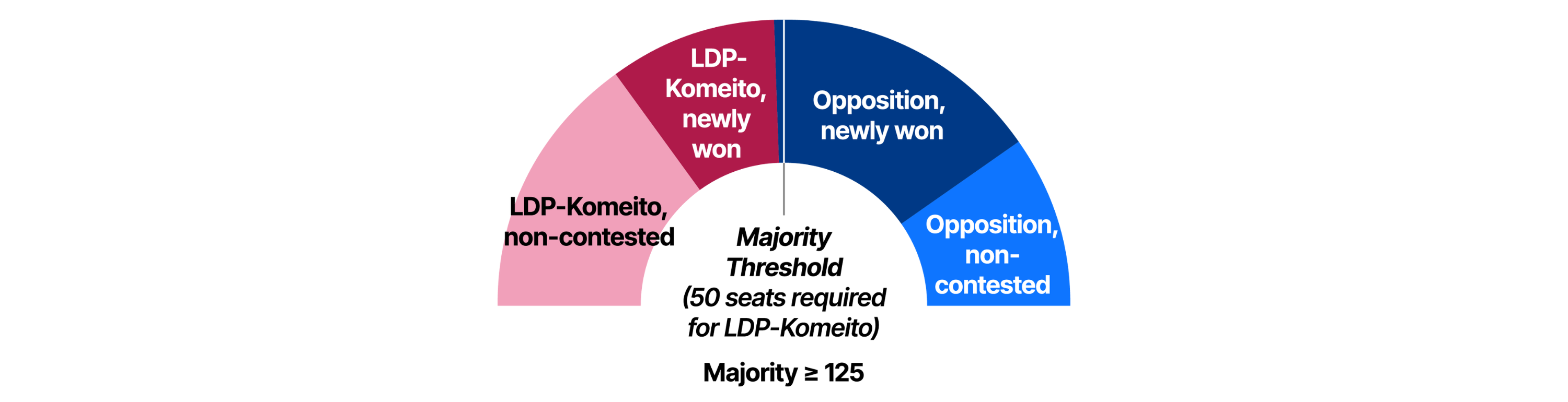

Japan’s ruling coalition, comprising the Liberal Democratic Party (LDP) and its junior partner, Komeito, failed to retain its majority in the July 20th Upper House election, marking a significant political blow to Prime Minister Ishiba’s administration.

Held every three years, Japan’s Upper House renew half of the 248-member chamber under a staggered system designed to maintain institutional continuity within the National Diet. Ahead of the vote, the ruling coalition controlled 75 of the uncontested seats, requiring at least 50 of the 125 contested seats to preserve a majority. Ultimately, the coalition fell short, securing only 47 seats—39 for the LDP and 8 for Komeito—three shy of the threshold.

Though the Upper House does not select the prime minister, these mid-term elections are widely seen as referendums on the governing party’s performance. This year’s contest was broadly viewed as a litmus test for Prime Minister Ishiba’s leadership, set against the backdrop of surging living costs and the emergence of populist challengers. The results signal a growing erosion of public confidence in the ruling bloc, and underscore mounting voter discontent over economic pressures, perceived policy inertia, and a widening disconnect between government and citizenry.

Addressing the nation after the exit polls closed on Sunday night, Ishiba told NHK he “solemnly” accepted the “harsh result.” In a subsequent interview with TV Tokyo, he reaffirmed the government’s foreign policy direction, stating: “We are engaged in extremely critical tariff negotiations with the United States... we must never ruin these negotiations. It is only natural to devote our complete dedication and energy to realizing our national interests.” Despite speculation from within the LDP and the media that he might resign in the wake of the disappointing outcome, Ishiba signaled his intention to remain in office, stressing the need for leadership continuity amid sensitive diplomatic negotiations.

The Rise of Minor Opposition Parties

In the 2025 Upper House election, several smaller parties gained traction and heightened visibility. While their overall seat counts remain limited, their growing appeal highlights shifting voter sentiment and rising disillusionment with both the ruling coalition and traditional opposition parties. Sanseito jumped from just one contested seat to 14, and the Democratic Party for the People (DPP) expanded its contested-seat count from 14 to 17. These rapid gains underscore a deepening political fragmentation and reflect an electorate increasingly seeking viable alternatives to the mainstream.

Emerging from a grassroots movement propelled by YouTube and digital activism, the party appeals to voters disenchanted with both the political establishment and conventional opposition forces. Its messaging blends nationalist identity politics with deep institutional distrust, emphasizing themes such as “protecting Japan,” “restoring pride,” and “putting Japanese citizens first.” Rather than offering a detailed policy platform, Sanseito leans on emotionally charged narratives that resonate with socially conservative and economically insecure segments of the electorate.

The party’s meteoric rise has been driven by a savvy digital strategy, particularly through fringe social media platforms and online influencers, which has allowed it to circumvent traditional media channels and amplify anti-elite, anti-foreign sentiment. Its core issues include skepticism toward immigration, foreign land ownership, and globalism—framed less as technical policy concerns than as threats to cultural sovereignty. While its voter base remains relatively narrow, Sanseito’s growing prominence and capacity to mobilize disaffected conservatives point to a broader transformation in Japan’s political landscape. Its ascent reveals a populist undercurrent that neither the LDP nor progressive parties have successfully absorbed—and one that may reshape the tone and contours of national discourse, regardless of the party’s legislative footprint.

Democratic Party for the People (DPP)

Positioning itself as a “policy-first” alternative to both the ruling LDP and Japan’s fragmented progressive opposition, the DPP has successfully tapped into the anxieties of economically burdened, working-age voters. It emphasizes practical economic solutions—including wage-led growth, targeted tax relief, and reforms to the so-called “annual income barrier” that disincentivizes dual-income households—while avoiding the ideological rigidity of both political spectrums.

On national security and energy, the DPP distinguishes itself by advocating a pragmatic reinterpretation of Article 9 and supporting the use of nuclear power as part of a balanced energy portfolio. Its message resonates with voters who are frustrated with soaring living costs and disillusioned with both establishment inertia and radical alternatives. However, the party’s rapid expansion also raises concerns about its internal cohesion and long-term durability. Past scandals and instances of policy inconsistency remain notable vulnerabilities, and the DPP’s future credibility will hinge on its ability to sustain a reform-oriented identity without sliding into opportunistic populism or ideological ambiguity.

Political Engagement on the Rise—With Social Media Cutting Both Ways

A significant uptick in voter turnout accompanied the growing visibility of minor opposition parties in this election. Participation reached 58.51%, a 6.46-point increase over the previous Upper House election in 2022, and marked the first time in 15 years that turnout has surpassed the 55% threshold (The Japan Times).

Digital platforms played an instrumental role in driving this heightened engagement, acting as conduits for political information, grassroots mobilization, and amplified candidate visibility. However, the campaign period also exposed the double-edged nature of social media: while it democratized access to political discourse, it also enabled the rapid proliferation of false or misleading content, raising concerns about electoral integrity and information hygiene in Japan’s digital public sphere.

A Snapshot of the Increasingly Multiparty Landscape

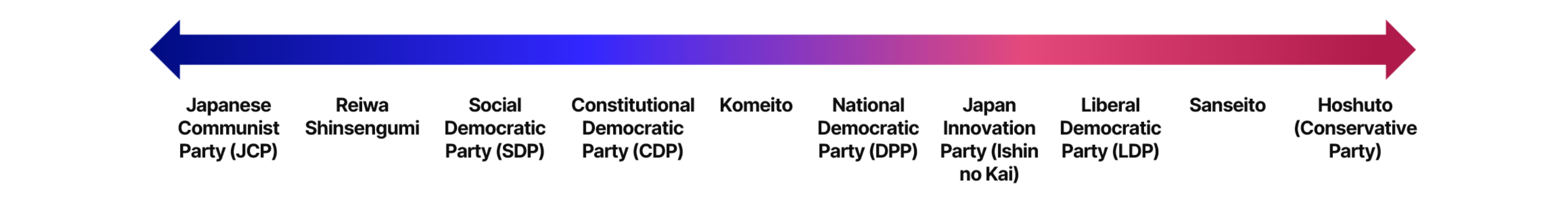

Political spectrum

A left-to-right ideological map showing how Japan’s major parties align on core political values:

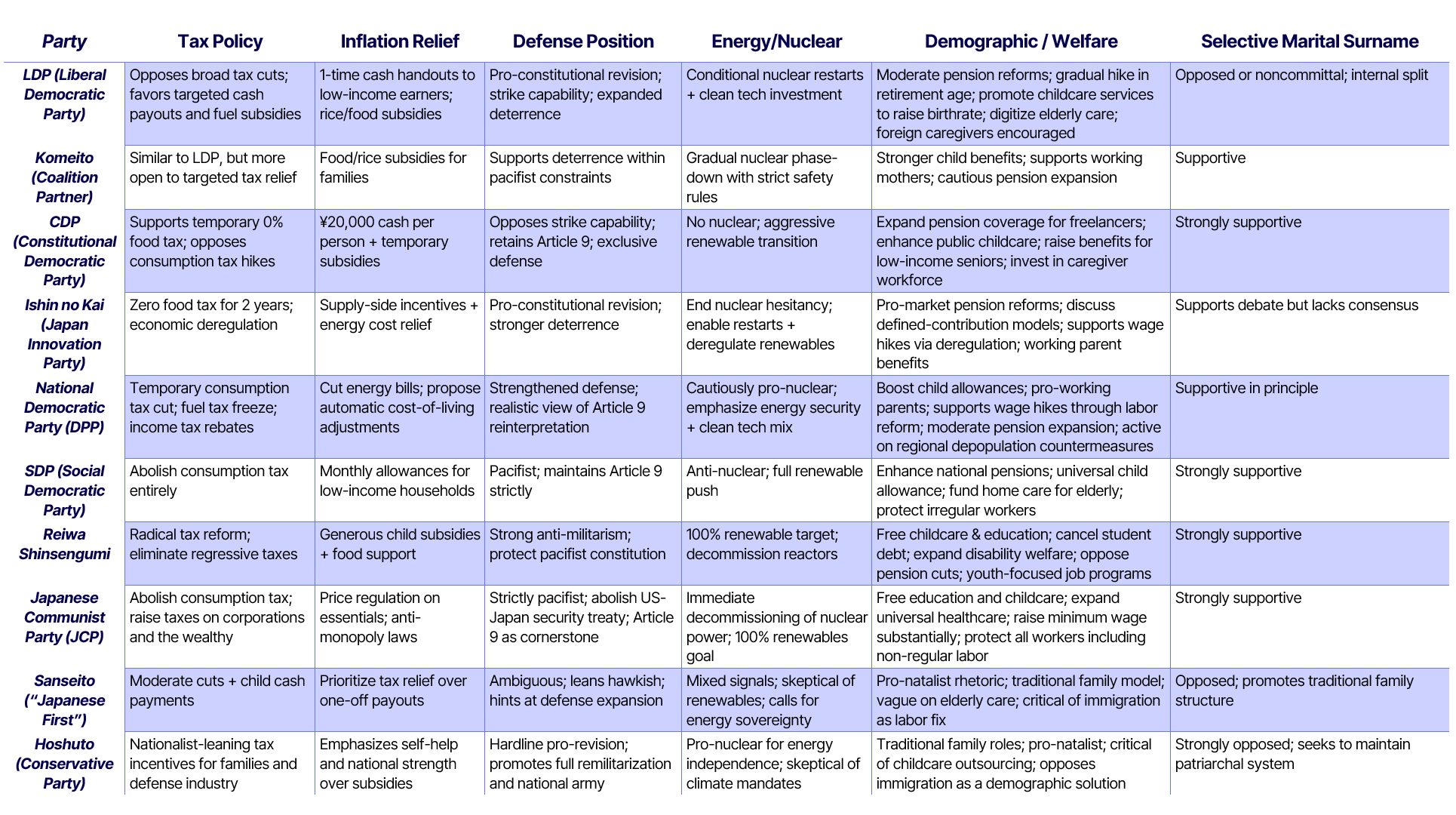

Position on key policy issues

A side-by-side comparison of party stances on taxation, inflation relief, defense, energy, social policy, and selective marital surnames—key issues shaping post-election policymaking:

What Does It Mean?

Short-Term: Impact on Ishiba and the LDP

A weakened mandate and immediate political headwinds

The ruling coalition’s failure to retain its majority in the Upper House represents both a symbolic setback and a tangible constraint for Prime Minister Ishiba. While he has stated his intention to remain in office, the outcome lays bare internal divisions within the LDP and is likely to heighten pressure from rival party factions. With political momentum curtailed, Ishiba’s capacity to advance an assertive policy agenda—particularly on fiscal reform, national security, or constitutional revision—has been significantly diminished.

Policy gridlock looms—in both chambers

The coalition’s setback in the Upper House is further compounded by the fact that the LDP no longer commands a standalone majority in the Lower House. This dual vulnerability significantly heightens the risk of legislative paralysis. Even routine policy matters may now require delicate coordination with opposition forces such as the DPP or Ishin no Kai—whose policy agendas often diverge from the government’s.

As the administration becomes increasingly dependent on political deal-making, its shrinking capital and fragile mandate are likely to result in key initiatives being delayed, diluted, or derailed. Within the ruling party, Ishiba’s leadership could become more defensive and reactive, focused less on advancing reform and more on navigating internal dissent and political survival.

Long-Term: Populist Realignment and the Anti-Establishment Undercurrent

Beyond the seat counts, the deeper story of the 2025 Upper House election lies in the continued erosion of public trust in Japan’s traditional political establishment. Voters increasingly gravitated toward alternative voices—most notably Sanseito and the DPP—not due to shared ideological vision, but because these parties offered a rupture from entrenched political narratives that have consistently failed to address the public’s mounting concerns: economic insecurity, demographic strain, and a growing sense of social disconnection.

- Sanseito leverages identity politics, nationalism, and anti-globalist sentiment. Its rhetoric echoes that of far-right populist movements in Europe and the US, appealing to voters who feel that Japanese sovereignty, cultural heritage, and traditional values are under siege.

- The DPP, while less ideologically polarizing, adopts a pragmatic form of populism focused on economic grievances—advocating policies such as fuel tax cuts, wage growth, and enhanced family support, particularly aimed at working-age voters and regional constituencies.

Despite their ideological differences, both parties respond to the political void: they give voice to voters who feel neglected, economically squeezed, and politically unheard by a governing class absorbed in factional maneuvering and risk-averse consensus-building. Mainstream parties, especially the LDP and Constitutional Democratic Party (CDP), have struggled to deliver messages that address this sense of precarity and disenchantment.

In this sense, the 2025 election reflects a broader global trend—a realignment in which political legitimacy is shifting away from traditional party machines toward outsider narratives that promise clarity, resolve, and a departure from incremental politics. Japan’s populist wave may appear more muted than its Western counterparts, but its emergence is no less consequential.

Policy Implications for Businesses

A new current in Japanese politics is clearly emerging. In the 2025 Upper House election, rising opposition parties made notable gains by tapping into public discontent and disrupting the established political order. Their ascent signals a growing receptiveness to populist rhetoric, greater policy unpredictability, and a more fractured legislative landscape—developments that carry far-reaching implications for businesses, investors, and policymakers seeking to navigate Japan’s shifting political terrain.

Immediate Market Reaction: “Triple Sell-Off” Averted

Bond Yields Rise on Fiscal Expansion Concerns

On July 22, Japan’s domestic bond market saw the benchmark 10-year government bond yield rise to 1.535%, a 0.010 percentage point increase from the previous week. The uptick reflects investor concern that the ruling coalition’s failure to retain a majority in the Upper House may pave the way for expanded fiscal spending, including tax cuts or direct cash transfers, in response to pressure from emerging opposition demands (Nikkei).

Tokyo Stocks Stabilize as Political Uncertainty Eases

Also on July 22, Japan equities showed signs of stabilization, with the Nikkei 225 projected to rebound by approximately 200 points, hovering near the 40,000-yen threshold. Although the ruling coalition lost its majority in the Upper House, the outcome was viewed as less disruptive than initially feared. Prime Minister Ishiba’s decision to remain in office helped ease investors’ concerns over immediate political instability, reducing downward pressure on equities (Nikkei).

Yen Firms Briefly, but Policy Uncertainty Weighs

The yen strengthened modestly in the immediate aftermath of the Upper House election, briefly appreciating into the upper 147-yen range against the dollar. However, the currency soon drifted lower as markets reassessed their fiscal and political risks. While the ruling coalition’s loss was milder than expected, concerns remain about potential fiscal loosening, pressure on credit ratings, and unresolved US–Japan tariff negotiations. Amid persistent uncertainty regarding the government’s stability and policy direction, the yen remains susceptible to renewed depreciation (Nikkei).

Risks for Foreign Businesses

The 2025 Upper House election has amplified political rhetoric critical of foreign capital and ownership, fueled mainly by the rise of populist and nationalist parties such as Sanseito and Hoshuto. While neither party is expected to exert direct influence on policymaking in the immediate term, their growing visibility is reshaping the public discourse and could foster bipartisan consensus around foreign investment. Overtime, this shift may narrow the political and regulatory space for pro-investment policies, especially in sectors perceived as sensitive to national interest or cultural identity.

Key Risks

- Increased Scrutiny of Foreign Ownership: Calls for tighter regulations on foreign land, property, and media ownership may gain traction, especially in politically sensitive areas such as Okinawa, Hokkaido, and near military installations.

- Hostility Toward Foreign Labor Policies: Pushback against immigration may complicate the expansion of foreign-backed service sectors that rely on multilingual or migrant labor (e.g. tourism, hospitality, elder care).

- Regulatory Nationalism: Sanseito’s rhetoric on “economic sovereignty” could influence future proposals around digital platforms, cross-border data flows, and procurement rules—even without formal legislative authority.

- Reputational Risk: Foreign companies may face reputational friction in local communities, especially if portrayed as contributing to inflation, land speculation, or cultural dilution.

Mitigation Considerations

Mitigation Considerations

- Local Engagement: Strengthening relationships with local governments, communities, and Japanese SMEs can provide buffers against nationalist framing.

- Narrative Framing: Emphasizing long-term contribution to regional revitalization, technology transfer, and employment stability can help counter negative narratives.

- Policy Monitoring: Increased vigilance is recommended around proposals related to land use, digital security, and inbound FDI review mechanisms.

Opportunities for Businesses

Political Fluidity

Japan’s 2025 Upper House election has diminished the ruling LDP’s dominance, unveiling a more fragmented and fluid political environment. While this development raises familiar concerns over policy paralysis, it also signals a weakening of entrenched power structures and presents new opportunities for businesses to engage more strategically and selectively within Japan’s evolving political ecosystem.

For decades, many companies have defaulted to a risk-averse, LDP-centric approach to political engagement. While maintaining close cooperation with the LDP remains essential, the emerging landscape requires a more diversified engagement strategy, including proactive dialogue with other political actors. This growing fluidity creates space to:

- Collaborate with reform-oriented policymakers who are advancing innovation and economic revitalization

- Engage with local governments that are actively seeking external partnerships to address demographic and economic challenges

- Connect with a rising generation of political leaders who bring fresh perspectives and a strong interest in global best practices

This is not merely a tactical opening—it marks a structural shift. As Japan undergoes a generational transition, both political and economic powers is gradually dispersing from entrenched legacy networks toward a more pluralistic and reform-driven ecosystem. Companies that recognize and adapt to this shift will be well-positioned to influence emerging policy coalitions and spearhead regionally driven pilot initiatives in priority areas such as healthcare, mobility, education, and digital infrastructure. In this new landscape, agility, local engagement, and political diversification will be key enablers of long-term strategic impact.

Converging Priorities: Defense and Energy as Strategic Business Frontiers

While Japan’s political landscape is becoming increasingly fragmented, national security and energy resilience stand out as areas of shared urgency among both the ruling LDP and key emerging parties. This cross-party alignment—though not uniform—offers a relatively stable foundation amid broader political volatility, creating meaningful openings for business engagement in strategically significant sectors.

Japan is ramping up defense spending and accelerating the modernization of its security posture. This includes enhanced public-private collaboration in areas such as cybersecurity, aerospace, and dual-use technologies. As Japan deepens security cooperation with key allies, businesses capable of contributing to interoperability, supply chain resilience, and advanced systems development will find growing and sustained opportunities.

On the energy front, policy is shifting in response to geopolitical tensions, supply chain disruptions, and long-term sustainability imperatives. The government is reactivating nuclear power plants, expanding LNG import capacity, and boosting investment in renewables and grid modernization. Concurrently, regulatory reforms are being introduced to support this rebalancing, opening new space for firms with expertise in energy security, transition technologies, and infrastructure resilience.

Media Coverage

Ishiba and the LDP’s Political Future

Media coverage highlighted the ruling party’s weakening grip, with calls for Ishiba’s resignation surfacing alongside broader concerns over the LDP’s ability to navigate Japan’s increasingly fragmented political landscape.

- Asahi: “LDP–Komeito Rule Has Reached Its Limits: With Growing Multiparty Fragmentation, the LDP Bears Greater Responsibility for Consensus-Building”

- Sankei: “Prime Minister Ishiba Officially Declares Intention to Stay, but ‘Unthinkable,’ Say Critics — Komeito Offers Support as Calls for Resignation Erupt from Within the LDP and Local Branches”

Populist Undercurrents and Rightward Shift

Both Japanese and international coverage emphasized the rise of populist forces and Japan’s alignment with global rightward political trends.

- Nikkei: “The Global Surge of the Right Reaches Japan: Sanseito Captures Public Distrust in the Establishment”

- In recent years, far-right parties in Europe—such as Germany’s AfD, France’s National Rally (RN), and Austria’s Freedom Party—have gained ground by promoting anti-immigrant platforms. […] They share many similarities with Sanseito. Amid economic stagnation and growing public frustration, these parties expanded their support by criticizing establishment elites and mainstream parties for ignoring the interests of ordinary citizens.

- Economist: “Populism and Polarisation Come to Japan”

- For years Japan had seemed to escape the populism and polarization that has upturned politics in many other rich democracies. That is clearly no longer the case.

- The New York Times: “Japan’s Long-Dominant Party Suffers Election Defeat as Voters Swing Right”

- Japan’s long-governing Liberal Democratic Party suffered a defeat in parliamentary elections on Sunday that saw new right-wing populist groups make gains, heralding what could be a tectonic shift in what has been one of the world’s most stable democracies.

- BBC: “The Rise of the Far-Right ‘Japanese First Party’”

- Sanseito’s ascent may signal a turning point in Japan’s political landscape.

Materials presented by Edelman’s public & government affairs experts. For additional information, reach out to Yuichi.Kori@Edelman.com