Navigating Investment Opportunities and Challenges in Indonesia’s New Capital City

At a Glance

Indonesia is moving its capital from Jakarta to Ibu Kota Nusantara (IKN) in East Kalimantan Province, on a separate island northeast of Jakarta. Both the Government and Parliament ratified the relocation under Law 3/2022 and a series of implementation regulations have also been released to direct area planning, business and land permitting, and development financing.

The Government is also preparing incentives and additional benefits for contributing investors, presenting investment opportunities for national and multinational companies seeking to enter the Indonesian market or expand their existing Indonesia operations to Central or Eastern Indonesia.

Amidst a challenging investment climate during elections and the global economic slow-down, Indonesian policymakers could consider efforts to provide investment clarity through clearly identified and well-orchestrated information sources in delivering progress updates. From the investors’ side, close monitoring of additions to or revisions of Law 3/2022 will be vital in navigating investment opportunities in IKN.

From Ideation to Progress

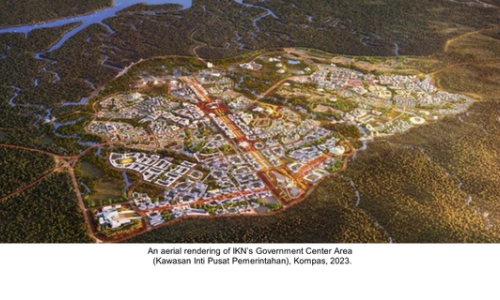

In 2019, President Joko Widodo first promoted plans of relocating Indonesia’s capital from Jakarta on Java Island to Ibu Kota Nusantara on Borneo Island. The name Ibu Kota Nusantara, commonly referred to as IKN, means Nusantara Capital City and first surfaced in 2022 followed by the establishment of Law 3/2022 as the legal basis for its development. The purpose of the megaproject is to distribute development to Eastern Indonesia and alleviate Jakarta’s double burden as Indonesia’s center of government and business. IKN is expected to provide better infrastructure, reduce traffic congestion, and offer a more sustainable and livable environment.

from Jakarta on Java Island to Ibu Kota Nusantara on Borneo Island. The name Ibu Kota Nusantara, commonly referred to as IKN, means Nusantara Capital City and first surfaced in 2022 followed by the establishment of Law 3/2022 as the legal basis for its development. The purpose of the megaproject is to distribute development to Eastern Indonesia and alleviate Jakarta’s double burden as Indonesia’s center of government and business. IKN is expected to provide better infrastructure, reduce traffic congestion, and offer a more sustainable and livable environment.

The Government consistently promotes IKN as a strategic hub that will unlock more economic potential for Indonesia, given its geo-strategic location near trade routes in the Celebes Sea, Arafura Sea, and the Pacific Ocean. In addition, the new capital city promises a sustainable and green urban development landscape that caters to 1.9 million people initially and, by 2045, 4.8 million jobs in tech, petrochemicals, and renewable energy.

Aiming for project completion by 2045, development stages are divided into five phases. By May 2023, IKN’s Phase 1 development progress had reached 29% of basic infrastructure development such as residential towers, toll roads, and central government buildings. With several years of development already underway, the endeavor will require a total budget of approximately USD 32.7 billion to finish. As about 80% of the funding is expected to come from private investments, the project presents investment opportunities for businesses seeking to expand their operations in Eastern Indonesia or those that wish to invest in Indonesia in infrastructure, technology, education, and housing.

This project is already receiving significant interest from businesses interested in investing in IKN for the nation's economic growth and development. To date, the Indonesian Government has received 209 letters of interest, of which 36 of them have signed nondisclosure agreements. The country has implemented several strategic moves, including the realization of special policies for IKN’s financing, investment incentives, and development planning, reflecting the government’s provision of an enticing environment for investors and advancing the progress of this project.

Indonesia’s Policies and Incentives to Fuel IKN Growth

Ratification of Law 3/2022 was crucial in realizing a new strategic hub in Central Indonesia to mobilize the Indonesian economy eastward. Policymakers have released a series of implementation regulations outlining IKN’s development planning, financing, and investment—three areas at the core of city development:

- Business and land permitting:

- Regulations No. 12 in 2023 — Regulates business permits, ease of doing business, and investment facility for companies in IKN

- Presidential Regulations No. 65 in 2022 — Addresses land acquirement and development in IKN

- National Development Planning Ministry/National Development Planning Agency Regulations No. 6 in 2022 — Procedures for Government-Business Partnership for IKN development

- Financing:

- Regulations No. 17 in 2022 — Financing and budget management for the capital city preparation, development, and relocation

- Ministry of Finance Regulations No. 220 in 2022 — Government support for Government-Business Partnership and creative financing in accelerating IKN development

- Development and spatial planning:

- IKN Authorities Regulations No. 1 in 2023 — Detailed spatial planning for core central government area of IKN

- IKN Authorities Regulations No. 2 in 2023 — Detailed spatial planning for West IKN

- IKN Authorities Regulations No. 3 in 2023 — Detailed Spatial Planning for East IKN 1

- IKN Authorities Regulations No. 4 in 2023 — Detailed Spatial Planning for East IKN 2

The IKN Authorities/OIKN oversee the city’s planning and development alongside releasing regulations, and is also preparing supportive regulatory incentives to attract investors. This package includes streamlined licensing processes and tax exemptions. According to Head of OIKN Bambang Susanto and Deputy Head of OIKN Dhonny Rahajoe, the Government will bear the burden of Value Added Tax (VAT) and Income Tax, while professionals who work in IKN for a certain length of time will be granted exemptions. Moreover, there are plans for a 30-year tax holiday and tax deductions for vocational projects such as infrastructure development and park construction.

Despite the series of regulatory releases, there is scrutiny of the investment prospects for IKN as the Government is facing challenges to secure funding by 2024 for the Phase 1 development. Another essential task is ensuring a stable investment climate and building investor confidence, both within Indonesia and in the international sphere, in order to catalyze investors’ decision-making process to participate in large-scale projects.

Similar capital city relocations have occurred in other G20 economies, such as South Korea and Brazil. Both megaprojects shared a vision of redistributed economic and population growth in the new capital city and its supporting regions. In South Korea, Sejong’s relocation progress highlights the importance of political commitment and legal assertiveness while, in Brazil, Brasilia’s housing disparity raises the stakes of urban and population management. Indonesia may have a distinct case from South Korea and Brazil since its relocation spans two different islands, but the comparison does highlight the importance of addressing investment issues expeditiously during Phase 1 to allow deliberation and adherence to the city’s development plan in later stages.

Examining IKN’s Development Stability

Indonesia will enter an election period in 2024 to elect the head of state, heads of provinces, and both central and regional parliaments, which could shift Indonesia’s overall regulatory dynamics. Article 24 of Law 3/2022 has addressed this concern: IKN preparation, development, and relocation should become a national priority program for a minimum of 10 years or until Phase 3 of the development process. However, changes in policy dynamics in IKN’s satellite cities may also impose a wait-and-see behavior among investors of supporting infrastructure. There is a tendency among investors to calibrate investments according to the Government’s trajectory. Therefore, many investors are taking a cautious approach during this transitional period in order to better evaluate the probable impact of the election on the overall investment landscape.

Interested investors could reach out to OIKN and the IKN Investment Acceleration Task Force or initiate dialogues through business chambers. Businesses might also need to scrutinize Indonesian Parliamentary discussions on the revision of Law 3/2022, as the Ministry of National Planning/Development Agency (Bappenas) said that any revision would complement existing regulations related to land ownership, financing, and authorities’ expansion. Parliamentary debate will likely occur during the Fifth Hearing of 2022-2023, expected to take place between May 16 and July 13 this year.

Further Reading:

Why Is Indonesian Government Rushing to Revise Capital City Law?

President orders establishment of integrated system for IKN investors

Can Indonesia’s new capital Nusantara rival the fintech hubs of SG and HK?