Japan’s February 8 Lower House election delivered a historic victory for Prime Minister Sanae Takaichi and the ruling Liberal Democratic Party (LDP). The LDP secured 316 out of 465 seats, achieving a two-thirds supermajority for the first time in postwar Japan. The outcome substantially expands the LDP’s political bandwidth, strengthening its ability to advance legislation even in the face of Upper House resistance. The election also exposed the limited electoral appeal of the newly formed Centrist Reform Alliance (CRA), reinforcing the broader fragmentation and weakness of Japan’s centrist opposition.

LDP’s strengthened mandate comes amid a complex geopolitical environment. Closer leader-level alignment with the United States creates momentum for cooperation in areas including economic security, while Japan continues to navigate a firm yet pragmatic approach toward China.

For businesses, the return of political stability and clearer policy direction provides a more predictable operating environment. Companies may wish to reassess medium- to long-term strategies in light of government priorities—including the “17 strategic sectors”—and consider selective engagement in areas such as AI, semiconductors, healthcare, defense, and energy security, where policy attention and public support are likely to remain sustained.

Election Results

A Snap Election Delivering a Landslide Mandate and Political Realignment

Japan’s February 8 Lower House election marked a sharp political reset. What began as a snap election aimed at stabilizing governance instead produced a historic landslide win for Prime Minister Takaichi and the ruling Liberal Democratic Party (LDP), marking a potential end to political instability that followed successive election setbacks in 2024 and 2025 and delivering unprecedented control of the Diet’s lower chamber.

Japan’s February 8 Lower House election marked a sharp political reset. What began as a snap election aimed at stabilizing governance instead produced a historic landslide win for Prime Minister Takaichi and the ruling Liberal Democratic Party (LDP), marking a potential end to political instability that followed successive election setbacks in 2024 and 2025 and delivering unprecedented control of the Diet’s lower chamber.

The election followed major political realignment, including the collapse of the long-standing LDP–Komeito coalition and the formation of a cooperation framework with the Japan Innovation Party (Ishin). These developments, outlined in our earlier thought leadership Birth of the Takaichi Administration, set the stage for a high-stakes test of voter confidence.

Japan’s Lower House consists of 465 seats: 289 elected from single-member districts and 176 from proportional representation. Voters cast two ballots—one for a candidate and one for a party—under a parallel system that does not correct for disproportionality.

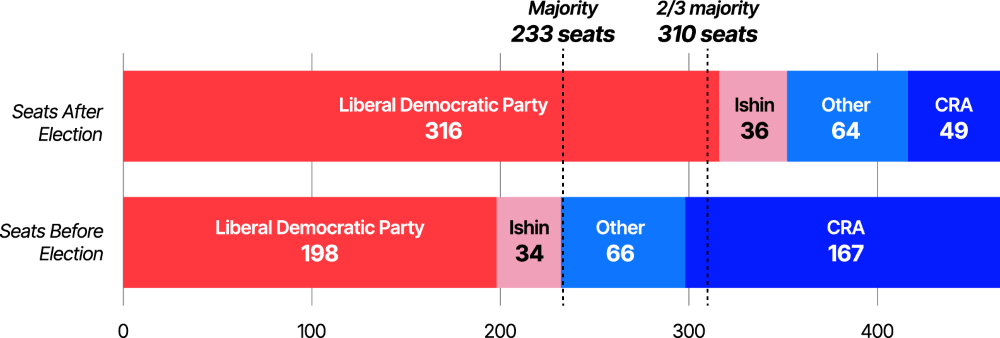

The results were decisive. The LDP secured 316 seats, the largest share held by any party in postwar Japan and the first time a single party exceeded a two-thirds majority. Coalition partner Ishin won 36 seats, bringing the ruling bloc’s total to 352 seats and firmly consolidating legislative power. On the opposition side, despite the newly formed Centrist Reform Alliance (CRA)’s appeal to centrist base, it failed to gain traction with voters, winning only 49 seats—down from 167 before the election—with just 20.7% of its 236 candidates elected, underscoring persistent leadership and credibility challenges across the opposition.

What Does It Mean?

The LDP’s landslide victory was widely anticipated, driven in large part by the strong popularity of Japan’s first female prime minister. Entering the campaign with high approval ratings, Prime Minister Takaichi leveraged her visibility and assertive leadership style to attract support across demographic groups, including younger voters, while advancing a more conservative agenda on security, foreign resident policy, and governance. The snap election proved a tactical success, translating personal approval and opposition fragmentation into overwhelming legislative gains, including a two-thirds majority in the Lower House, while exposing the limited appeal of newly consolidated opposition forces such as the Centrist Reform Alliance (CRA).

Expanded Political Bandwidth for the Ruling Liberal Democratic Party (LDP)

Japan’s National Diet consists of two chambers: the House of Representatives (lower house) and the House of Councillors (upper house). While members of the lower house serve shorter terms, the lower house holds greater legislative authority. In particular, it can override the upper house in key legislative circumstances if it commands sufficient support.

Under Japan’s constitutional framework, legislation rejected by the upper house may still be enacted if it is repassed by the lower house with a two-thirds majority. Although the ruling LDP–Ishin bloc remains a minority in the upper house, its post-election control of 316 of 465 seats in the lower house secures that threshold, significantly strengthening the government’s ability to advance legislation and policy priorities.

Severe Setback for the Newly Formed Centrist Reform Alliance (CRA)

In response to Prime Minister Takaichi’s plan to call a snap election, Constitutional Democratic Party (CDP) and Komeito merged under the banner of the Centrist Reform Alliance (CRA) “to broaden the centrist base and prevent it from leaning further to the right.”

In response to Prime Minister Takaichi’s plan to call a snap election, Constitutional Democratic Party (CDP) and Komeito merged under the banner of the Centrist Reform Alliance (CRA) “to broaden the centrist base and prevent it from leaning further to the right.”

However, the alliance suffered a significant setback, losing more than 100 seats compared with its pre-election strength, leading to the resignation of the co-leaders. Key factors behind the alliance’s underperformance include the failure to bridge policy differences—particularly on foreign and security policy—as well as persistent voter skepticism that the merger was driven primarily by electoral expediency. Furthermore, within CRA, as electoral strategies favored ex-Komeito candidates, the former CDP bloc became the clear underperformer, with its Diet representation collapsing by approximately 85%.

Geopolitical Risk Environment Shaping Japan’s Business Outlook

United States

President Donald Trump’s visit to Japan last October featured carefully staged optics that evoked the Abe–Trump era, underscoring the emergence of strong personal chemistry between President Trump and Prime Minister Takaichi. This alignment was reinforced in the run-up to the election, when President Trump expressed his “Complete and Total Endorsement” of the Takaichi administration.

This election outcome has provided Prime Minister Takaichi with a strengthened political mandate, expanding her diplomatic bandwidth to pursue a leader-led approach to Japan–US relations. This trajectory is expected to elevate the role of summit diplomacy, with her planned visit to Washington DC in March emerging as the next key milestone in bilateral cooperation. The prime minister is signaling an interest in encouraging US participation in rare earth mining projects around Minamitorishima Island, Japan’s easternmost territory in the Pacific with significant rare earth potential.

China

During the election campaign, Prime Minister Takaichi’s firm stance toward China—amid heightened Chinese pressure on Japan following Diet remarks related to Taiwan—appears to have resonated with domestic voters. China’s foreign ministry has reiterated that China’s policy toward Japan remains consistent, unaffected by the outcome of any single election, while also calling for Japan to withdraw its statements about Taiwan. The prevailing sentiment among China’s business community and academic experts is caution with a guarded outlook on China-Japan relations. While Chinese pushback is expected to persist in the near term, the Japanese government has signaled its intention to pursue a dual-track approach, combining enhanced defense capabilities and closer coordination with like-minded partners with continued efforts to engage China through sustained dialogue.

At the same time, reports that President Trump may visit China the first week of April point to a degree of Washington’s engagement with Beijing. While Japan and the United States share broad concerns over China, their approaches are not fully aligned, highlighting the need for Japan to pursue a pragmatic path toward stabilizing relations with China. Whether the post-election mandate enables such an approach will be closely watched.

Policy Implications for Businesses

As cooperation with the United States in the area of economic security becomes increasingly important, tensions in Japan’s relationship with China—particularly risks related to supply chain fragmentation—are expected to persist, heightening the urgency of establishing domestic sourcing and production frameworks for strategic materials. Against this backdrop of elevated geopolitical risk, the Takaichi administration has positioned the “17 strategic sectors,” including semiconductors, AI, and cybersecurity, as top policy priorities. With the ruling bloc securing a decisive and stable supermajority in the Lower House, these policy initiatives are now widely expected to be advanced with greater momentum.

Market Reaction

Equity and Bond Markets

- Against the backdrop of the ruling bloc’s landslide victory and expectations for political stability, the Tokyo stock market surged on the day following the election, with the Nikkei 225 briefly reaching the 57,000 level for the first time during intraday trading. In contrast to the sharp rally in equities, movements in the bond market remained relatively limited.

Foreign Exchange Markets

- Prior to the election, market participants largely anticipated that a victory by the Liberal Democratic Party—campaigning on a platform of “responsible proactive fiscal policy”—would lead to further yen depreciation. However, in the foreign exchange market on the day after the election, the yen strengthened in certain phases. Market observers point to the view that Prime Minister Takaichi largely refrained from emphasizing consumption tax cuts during the campaign, leading to a broader perception that opposition-backed proposals for immediate consumption tax reductions were unlikely to be implemented in the near term—an assessment that appears to have contributed to yen strength.

Sector-Specific Impact

Investment momentum is expected to accelerate in growth sectors designated as part of the “17 strategic sectors,” particularly in areas such as healthcare, AI, semiconductors, and defense. Reflecting these expectations, stocks related to defense as well as AI and semiconductor industries rose in the equity market on the day following the election.

The Takaichi administration’s 17 strategic priority areas for investment:

- AI and Semiconductors

- Shipbuilding

- Quantum Technologies

- Synthetic Biology and Biotechnology

- Aerospace

- Digital and Cybersecurity

- Content Industries

- Food Tech

- Resources, Energy Security, and Green Transformation (GX)

- Disaster Prevention and National Resilience

- Drug Discovery and Advanced Medical Care

- Fusion Energy (Nuclear Fusion)

- Advanced Materials (Critical Minerals and Components/Materials)

- Port and Logistics Infrastructure

- Defense Industry

- Information and Communications Technology (ICT)

- Ocean Industries / Maritime Sectors

Healthcare

- Strengthen Drug Discovery Capabilities: Against the backdrop of intensifying geopolitical risks, including US–China tensions, the government has signaled its intention to strengthen research and development of domestically produced vaccines and therapeutics in order to ensure a stable domestic supply of pharmaceuticals.

- Promote Digital Transformation (DX) in Regional Healthcare Infrastructure: In response to population aging and depopulation in regional areas, the administration is expected to advance digital transformation in healthcare, including the use of AI for medical imaging and diagnostic support.

- Revise Medical and Long-Term Care Reimbursement: To improve the financial sustainability of hospitals and long-term care facilities and support wage increases for healthcare workers, the government has implemented increases in both medical service fees and long-term care reimbursement rates, underscoring a policy direction toward expanded spending in the social security sector.

Action Recommendations: Businesses should develop medium- to long-term strategies aligned with policy priorities, as drug discovery and healthcare DX are positioned as national strategic areas. By engaging in public–private partnerships and pilot programs, companies can capture growth opportunities in domestic pharmaceuticals and digital health, while closely monitoring changes in reimbursement and regulatory frameworks. At the same time, proactive dialogue with policymakers on AI adoption, data governance, and ethical considerations will be essential for effective risk management.

AI and Semiconductors

- Promote AI Deployment and Cross-Sectoral Utilization: The Takaichi administration has articulated a policy stance that positions AI as a foundational technology for enhancing industrial competitiveness and improving administrative efficiency. In addition to promoting the deployment of AI across a wide range of sectors, the government aims to create an enabling environment for private-sector-led AI adoption through investments in human capital development and the establishment of appropriate regulatory and governance frameworks.

- Strengthen Domestic Supply Chains for Semiconductors and Rare Earths: Recognizing that advanced semiconductors and rare earths are indispensable to the further development of AI, the Takaichi administration has identified the expansion of domestic production capacity and the diversification of procurement sources as key priorities. These efforts are to be supported through enhanced R&D assistance, workforce development, and infrastructure investment.

- Accelerate Data Center Development and Power Infrastructure Expansion: As the widespread adoption of generative AI is expected to drive sharp increases in data processing demand and electricity consumption, the government has signaled its intention to strengthen AI infrastructure by accelerating the development of domestic data centers. At the same time, it aims to secure a stable and cost-efficient power supply through the expanded use of renewable energy and next-generation power sources.

Action Recommendations: Companies in the AI and semiconductor sectors should treat expanded AI deployment and supply chain resilience as policy-driven growth opportunities and reassess investment and business strategies accordingly. Participation in government-backed initiatives—such as domestic semiconductor production, rare earth sourcing, and data center development—can support long-term competitiveness. Continued engagement with policymakers on power supply, talent development, and data governance will also be critical.

Defense

Following its victory in the Lower House election, the Takaichi administration can be seen as having secured public backing to accelerate progress toward achieving defense spending equivalent to 2.0% of GDP, ahead of schedule (with defense-related expenditures projected at approximately 1.8% of GDP in FY2025).

- Invest in Dual-Use Technologies: Prime Minister Takaichi has consistently emphasized the pursuit of economic growth through investment in dual-use technologies with both civilian and military applications. Japanese public and private sector actors have already begun promoting such dual-use products to markets including Northern Europe and Germany, where defense awareness has heightened in response to the conflict in Ukraine

- Expand Defense Equipment Transfers: The Takaichi administration has taken a proactive stance toward the effective liberalization of defense equipment exports to allied and like-minded countries. The ruling bloc’s electoral victory is therefore viewed as a tailwind for Japan’s defense industry. Historically focused on domestic demand—primarily procurement by the Ministry of Defense—the industry is now seeing growing expectations for the expansion of overseas markets.

Action Recommendations: Defense-related companies should view rising defense spending and the expansion of equipment transfers as medium- to long-term opportunities, while reassessing strategies beyond domestic demand to include allied and like-minded markets. Strengthening public–private collaboration through investment in dual-use technologies, alongside careful management of export controls and international norms, will be essential.

Materials presented by Edelman’s public & government affairs experts. For additional information, reach out to Yuichi.Kori@edelman.com.